After a tumultuous 2020, the FTSE 100 index rose back above 7,000 points last week and so far seems to be sticking above that landmark number. How much higher can it go in 2021? The next big round number is 7,500. The all-time high (depending on the data source) for the index is 7,903.5, which it hit in May 2018. So, I have to ask myself: could the FTSE 100 blow straight through that all-time high and hit the milestone of 8,000 points in 2021?

FTSE 100 hitting 8,000

For the FTSE 100 to keep rising, the share prices of the constituent 100 companies have to rise as well. What drives stock prices higher? Well, traditional thinking has it that when the economy is doing well, companies report higher profits. When companies are reporting increasing profits, their stock prices tend to rise.

Are FTSE 100 companies on aggregate going to be reporting higher profits this year? Compared to 2020, I think they should. Headline annual GDP growth figures (admittedly measures against a low base) for the UK are expected to be healthy in 2021 and 2022. That would result from a return to near or full economic activity and pent-up consumer spending being unleashed as coronavirus travel and activity restrictions are relaxed.

Gaining momentum

That consumer spending will find its way to the top line of the income statement of many FTSE 100 companies. In turn, assuming cost structures remain fairly constant, bottom line profits should fatten. And if increasing profits drive stock returns, then there appears to be ample fuel to push the FTSE 100 towards and perhaps through the 8,000 point mark.

However, the notion that earnings drive stock returns has been challenged. Aside from fundamental drivers, like earnings growth, momentum and animal spirits have been suggested as potentially important stock return drivers. The FTSE 100 is up 2,500 points since the lows of the 2020 market crash. That’s quite a run, and there is a tendency for rising prices to keep rising (until, of course, they don’t). When the economy is doing well and investors feel confident, they tend to invest in riskier assets like stocks. The wave of euphoria accompanying the end of a pandemic could help the FTSE 100 towards 8,000 points.

Holding the FTSE 100 back

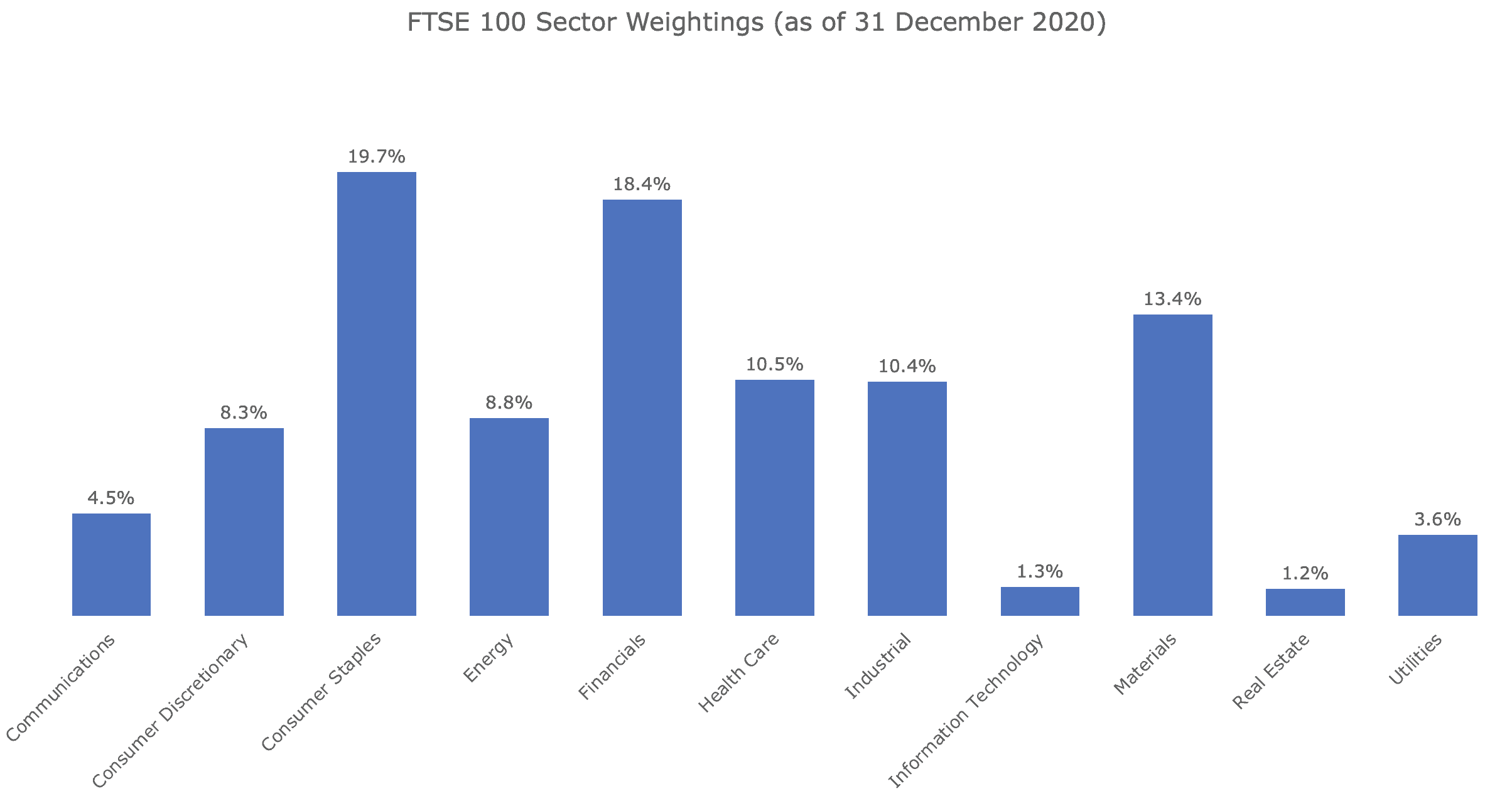

Despite the FTSE 100 rising 2,500 points in a year, the S&P 500 has left it in the dust. I think that’s mainly down to the mix of companies in each index. The FTSE 100 has a 1.3% weighting in the information technology sector. The S&P 500 has an almost 30% weighting in tech, including titans like Apple, Microsoft, and Facebook. These are the sorts of high-growth companies that would make a case for the FTSE 100 hitting 8,000 points this year more compelling.

Source: Siblis Research

The UK’s main index has a near 30% weighting in financials and energy. Banks, insurers, and oil majors might indeed see profits increase as the world economy booms. But I can’t see how consumer staples companies, which make up nearly 20% of the index and have benefitted from relatively stable revenues during the pandemic, can do much more in the pursuit of 8,000 points.

Of course, there is more to say on the matter. I could talk about the effect of dividend payouts, interest rates, and the UK’s relationship with the EU and the world post-Brexit, and more. Could the FTSE 100 hit 8,000 this year? I think it could. Will I be banking on it? No.