The Lloyds (LSE: LLOY) share price has soared 76% from a low of 23.98p just six months ago. Nevertheless, at a current 42.26p, the price remains well below its pre-pandemic level of over 60p in early 2020. Am I too late to buy? Or can the shares continue their recovery?

Here, I’ll discuss how my view of Lloyds has changed over the last decade, and give my take on the upside potential and downside risk at the current share price.

Lloyds and the economic cycle

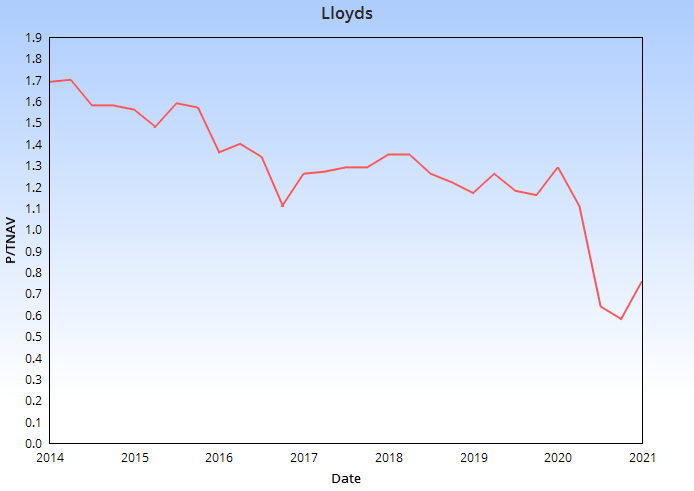

Banks’ profits wax and wane through the economic cycle. Their valuations do too — and in a broadly predictable manner. On this score, price/tangible net asset value (P/TNAV) is a useful measure. The chart below shows the highest P/TNAV Lloyds was rated at by the market in each quarter, from the end of 2013 to the first quarter of the current year.

In early 2014, Lloyds’ P/TNAV reached 1.7. This turned out to be the bank’s peak valuation in the cycle between the 2008/9 recession and last year’s pandemic recession. From 2014, investors became increasingly unwilling to pay as much for Lloyds’ assets. Yet the bank’s profits were rising and dividends were back on the agenda. So, what was going on?

The UK has suffered eight recessions across the eight decades since World War II. Five years after the 2008/9 recession, Lloyds’ declining P/TNAV reflected the market beginning to price-in the next economic downturn.

Value strategy

With highly cyclical stocks like Lloyds, I favour a value approach over long-term buy-and-hold. That’s to say, I favour buying when the P/TNAV is around its cyclical low and selling before the market starts pricing-in the next recession.

In the cycle we’ve just experienced, Lloyds’ P/TNAV high of 1.7 in 2014 was markedly lower than in the previous cycle. Meanwhile, its 2020 P/TNAV low — not shown on the chart, but 0.46 — was higher than the low of the 2008/09 recession.

I was looking for a P/TNAV in the 0.33 area for Lloyds last year. In hindsight, I think I was too greedy. I reckon the UK’s post-financial-crisis banking reforms — countercyclical capital buffers and so on — put something of a cushion under the P/TNAV low. I also now reckon the reforms mean Lloyds’ 1.7 P/TNAV high in the last cycle is probably a new normal too.

Lloyds share price and P/TNAV today

In future, I think my value play will be to buy Lloyds when its P/TNAV is around 0.5 and sell at around 1.5. But where does this leave me now? Lloyds’ P/TNAV is 0.81 at the current share price of 42.26p.

If the economy is in a sustainable recovery, I could still enjoy some very decent returns from Lloyds by buying the shares at today’s price. Set against this is the risk of a double-dip recession. The economy could slump when the government winds down financial support for people and businesses.

Having already missed a significant expansion in Lloyds’ P/TNAV, I think it may be a little late for me to buy, in terms of risk-managing my value strategy. If I’d taken the plunge last year, I’d have locked in a good margin of safety and would see the stock as a hold right now.

As it is, I may have to wait for the next economic cycle to play out, unless a double-dip recession provides me with a buying opportunity.