Last Friday (26th February) Rightmove (LSE: RMV), the UK’s most popular online property advertising platform, reported earnings for FY2020. At first glance earnings looked fairly disastrous, with revenue and operating profit falling 29% and 37% respectively. Investors reacted negatively to the news, with the company’s share price declining nearly 7% in the immediate aftermath. In the last few days, Rightmove stock has recovered some of its losses, rising over 3%. However, at a share price of 584p at the time of writing, its shares are still down 10% year-to-date.

Is it really that bad?

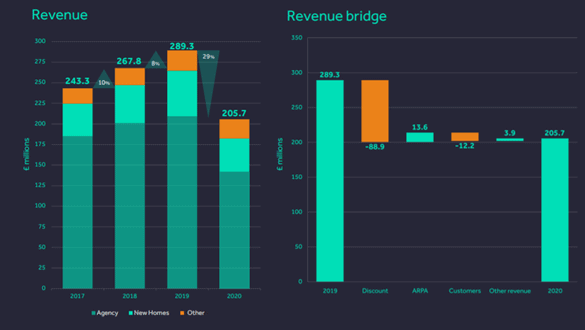

While the headline figures certainly make for bad reading, there are several reasons to be optimistic about Rightmove stock. One reason is that FY2020 earnings were not as bad as the headline figures suggest. From April to July 2020, Rightmove offered agents and new home developers advertising on its platform a discount of 75%. This was reduced to 60% and 40% in August and September respectively. As the figure below demonstrates, this was the primary reason for the reduction in revenues in 2020. In fact, without the discount, Rightmove stock would have grown revenues in 2020.

There were other positives regarding performance in 2020. Traffic to Rightmove’s platform grew substantially during the period, up 31% from the previous year as lockdown accelerated the trend of property advertising moving online. The number of advertisers on its platform also remained steady, only falling 3% during the period and, if one adjusts for the discount, average revenue per advertiser (ARPA) actually grew during the year as more advertisers upgraded to Rightmove’s premium packages.

Another reason to be optimistic about Rightmove stock is its strong fundamentals. With a market share of over 80%, the firm has a strong position in its market. This has allowed Rightmove to maintain very high margins with operating and net profit margins averaging 72% and 58% respectively over the last five years.

As mentioned, Rightmove is also benefiting from a long-term trend of property advertising moving away from brick and mortar sites to online platforms. This, coupled with its strong competitive position, has enabled the company to grow substantially and consistently. Over the five years before the Covid-19 pandemic, Rightmove’s revenues and net profits grew at an annual rate of 11.6% and 12.3% respectively.

Looking forward, the future for Rightmove looks bright. Not only is the trend towards online property adverting a major catalyst for future growth, but now that the discount has been removed, the company looks set for a swift recovery in 2021. Indeed, management stated that they expect to see financials return towards 2019 levels in 2021.

Am I buying Rightmove stock?

Although I think Rightmove is a great company, the price at which it is trading currently is too expensive for me. At the time of writing, the price to earnings (P/E) ratio of Rightmove stock stands at 46. Even if earnings recover to 2019 levels in 2021, this would still give the company a P/E ratio of 30 in one year. This is too high for me. As a result, I am going to wait for the are price to pull back further before jumping in.