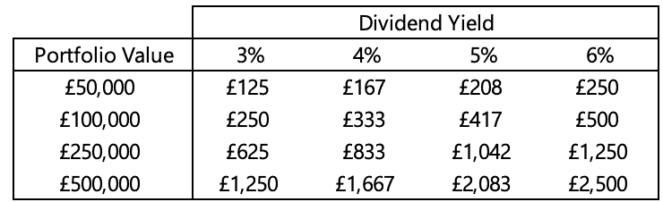

Passive income requires little to no effort to maintain. Imagine getting cash every month without having to lift a finger. Now that is something I would like! One way to generate a passive income stream is to build a portfolio of FTSE 100 dividend-paying stocks. A £250,000 portfolio with a dividend yield of 4% would generate £9,996 a year — or £833 every month — in passive income.

A £100,000 portfolio with yielding 5% in dividends per year would generate £417 a month in passive income. If those investments are held inside a Stock and Shares ISA, then there is no tax to pay, and the full £417 is available to spend as the investor chooses.

Source: Author’s own calculations

The table above shows the monthly passive income generated with portfolios of different amounts and dividend yields. The values are large and might seem unachievable. However, I don’t have to have a big portfolio right now. I want passive income in the future. I can invest relatively modest amounts each month, and over time, build a sizeable portfolio that pays big dividends. What’s more, those dividends that I am relying on to generate passive income in the future also help build the portfolio. Let me explain.

Reinvesting dividends

Albert Einstein is said to have remarked that compound interest is the most powerful force in the universe. How it works is simple. Money earns interest that increases the amount of money, which earns even more interest, and so on. If I invest £250 a month into reliable dividend-paying stocks for 25 years, and each dividend payment I receive is reinvested, I should end up with £129,018. That assumes the dividend yield is 4% and dividends are paid twice a year.

Squirrelling away £500 a month under the same conditions could build a £250,000 portfolio. And, I am only considering dividend reinvestment here. Any price increases will also add to the final value of the savings pot. Once the investing days are done, dividends, instead of being reinvested, can be drawn as a passive income stream.

Building passive income

So, what are the investment options? Investing in an FTSE 100 tracker fund is one way to go. Since its inception in 1984, the total return (including price appreciation and dividend reinvestment) on the FTSE 100 has been around 8% per year on average. FTSE 100 trackers typically come in accumulation (Acc) or Income (Inc) varieties. The former reinvest dividends automatically and would be a good choice for the portfolio building stage.

Once the wealth-building is done, and its time to start enjoying the passive income, then an FTSE 100 Inc tracker would be a good choice as these pay out dividends to the investor. The current dividend yield on the FTSE 100 is around 4.70%, although it has been as low as 2% and as high as 7% over the last two decades.

Alternatively, A basket of FTSE 100 stocks could be put together. This is what I am doing. I like the dividend hero stocks that have not cut their dividend in at least a decade. My portfolio includes the likes of Diageo, GlaxoSmithKline, and Unilever. I reinvest any dividends I receive and will continue to do so for another couple of decades at least. When I retire, I will stop reinvesting dividends and start paying myself a passive income from them.