Before I decide to invest in a FTSE 100 stock, I need to understand its income statement. FTSE 100 member Diageo‘s (LSE:DGE) income statement up to and including profit for 2020 is presented below. Let’s take a walk through it.

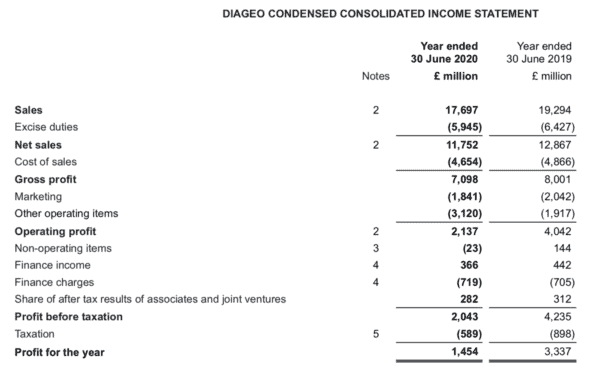

The first line reports the proceeds from sales of goods or services made during the business’s ordinary operations. Diageo reports sales of £17,697m for 2020. Excise duties are effectively production taxes payable when goods move from bonded premises. Diageo’s deducts excise duties of £5,945m from sales to arrive at net sales of £11,752m for 2020.

Source: Diageo

Getting bottles and cans of alcoholic beverages into bonded premises ready for sale costs money. There are ingredients to buy and employees to pay. There are also utility bills to pay when the employees use energy to turn those ingredients into something drinkable, then bottle it and make it ready for sale. These are the direct costs that make up the cost-of-sales expense, which for Diageo was £4,654m for 2020.

Profit and loss

Deducting the cost of sales from net sales give Diageo’s 2020 gross profit of £7,098m for 2020. Diageo it only recognises the cost of producing a box of drinks (in cost of sales) when it sells the box. But there are other costs like marketing, insurance, and head office salaries, that are incurred whether or not that particular box of drinks is sold or not. These operating expenses are deducted from gross profit to give Diageo’s 2020 operating profit of £2,137m.

Non-operating items, which are expenses or income not directly related to Diageo’s ordinary business, are subtracted or added to operating income next. Then there is financing income, perhaps from interest on cash balances, to add to operating income, and finance expenses, like interest on debt, to deduct. Diageo has stakes in other companies and joint ventures where it does not have full control. It recognises a share of their after-tax results in proportion to its control on its income statement.

Adding or subtracting non-operating items, adding finance income, deducting finance expense, and adding (or deducting in case of a loss) the share of after-tax results gives a profit before tax of £2,043m for 2020. Taxes of £589m are then deducted to give Diageo’s 2020 profit of £1,454m.

A good FTSE 100 company?

Is Diageo’s profit for 2020 good or bad? Compared to 2019 it is down 56%. Calculating the year-on-year changes for each line item on the income statement, as shown below, can help understand why. Sales fell by 8%, because of the pandemic, but other operating items expense increased by 63%.

Source: Diageo and author’s calculations

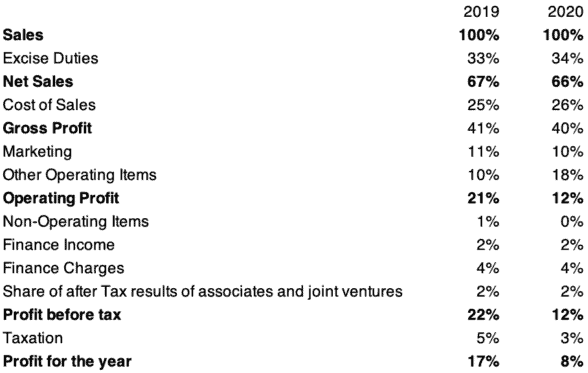

I show a common size income statement below, in which I calculated each line item as a percentage of sales. What draws my eye is that the other operating items percentage increases from 2019 to 2020, while other items are fairly stable. Again this seems to be driving the operating, before, and after-tax profits down for 2020. A careful reading of the notes accompanying the financial statements might reveal why this happened.

Source: Diageo and author’s calculations

Common size income statements and year-on-year change calculations are good ways to build an understanding of the performance of FTSE 100 companies like Diageo. Percentage-based calculations make comparisons with competitors straightforward. A consistently profitable company that is still growing, and outperforming its peers, is probably a good investment.