The Airbnb (NASDAQ: ABNB) IPO is today. Its stock is already a hot ticket. Airbnb priced its shares at $68 the day before its Nasdaq debut. That increase on the $56–$60 suggested previously reflects a couple of things. For one, recent tech IPOs have seen high price jumps on the first day of trading, suggesting those companies left money on the table for their shareholders. For another, with vaccines for Covid-19 rolling out the recovery of the travel industry looks to be not as far off as once feared. Finally, at the initial price, the Airbnb IPO did not seem especially richly priced.

According to the Financial Times, at an IPO price of $68 per share, the implied market capitalisation of Airbnb is $40.6bn. That would have put the IPO valuation of Airbnb, had it stuck to the $56–$60 range, somewhere between $34.6bn and $35.8bn.

Airbnb matches owners and renters of properties for travel and leisure and collects a fee for doing so. Booking.com does something similar (its more of a merchant of rooms) and has a market capitalisation of $86.3bn, which is around 9.6 to 9.9 times total revenue. At a market capitalisation of $40.6bn, Airbnb would appear to be valued at 8.4 times 2019 total revenue. All things considered, the Airbnb IPO does not look to be priced at eyewatering levels.

Bed and breakfast

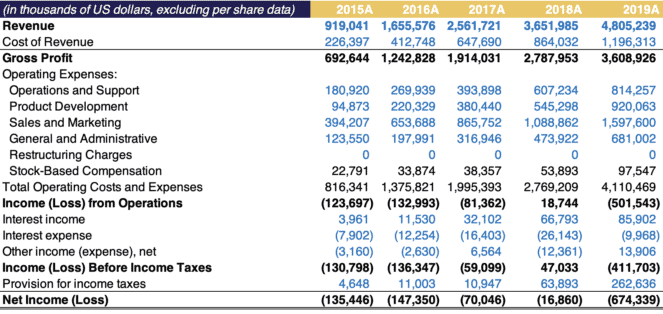

Where the price goes once trading in Airbnb stock begins is anyone’s guess. But it is likely that a UK based investor trying to buy Airbnb stock in a Stocks and Shares ISA, for example, will not be able to buy at $68 per share. Whatever the price is, buying Airbnb shares requires a belief that the company will continue to grow and find a way to be profitable. Referring to the income statement below, it can be seen that year-on-year revenue growth has been falling from 80.14% in 2016 to 31.58% in 2019.

Source: Airbnb IPO prospectus and author’s own calculations

Airbnb has been around since 2007. In fact, it reached 10m total bookings in 2012. In 2018 around 2m people were staying in an Airbnb rental on an average night. For a company at Airbnb’s stage in corporate life, revenue growth of 31.58% is still high. The market for home and apartment holiday and travel rental is huge but fragmented. Airbnb has come in and consolidated it, and I think revenues will continue to grow.

Airbnb’s gross margins have hovered between 75.1% and 76.35 from 2015 to 2019. Although Airbnb actually made an operating profit of $18m in 2018, 2019 was another loss-making year. Operating expenses excluding stock-based compensation as a percentage of revenue fell from 86.3% in 2015 to 74.4% in 2018. But they rose to 83.5% in 2019.

After the Airbnb IPO

Covid-19 hit Airbnb hard, but, after a precipitous drop, third-quarter 2020 revenues have recovered sharply. However, coming back from the virus is likely to drag on well into 2021 at least. Yet, Airbnb has demonstrated that it can turn an operating profit, so I am cautiously optimistic it can do this again.

As with all IPOs, investors should read the prospectus thoroughly (there is much more information there) and proceed with caution. There is a non-trivial risk that Airbnb will never become consistently profitable. Given the new and disruptive business model, there are regulatory risks. And, as with many tech IPOs, multiple share classes are mean reduced voting power for non-insiders.