Rolls-Royce (LSE: RR) is one of the most popular stocks on the London Stock Exchange right now. Both last week and the week before, Rolls was the second most bought stock on Hargreaves Lansdown.

Personally, I don’t see a lot of investment appeal in Rolls-Royce shares. Here, I’ll explain why. I’ll also highlight a UK growth stock I do like and have bought more of recently.

Rolls-Royce shares: would Warren Buffett buy?

The reason I don’t see much investment appeal in Rolls-Royce is that I view it as a ‘low-quality’ stock.

Just look at the company’s financials. In three out of the last five years, it has generated big losses. Analysts expect the group to generate another substantial loss this year.

Rolls-Royce also has a pile of debt on its balance sheet. In the group’s half-year results, it reported net debt of £1.7bn. The group has raised money to bolster its balance sheet recently. However, it’s still not financially strong.

Then there’s the dividend. This was cut substantially a few years back. Since then, the payout hasn’t been increased.

Putting all this together, Rolls-Royce is the kind of stock billionaire investor Warren Buffett would run a mile from. Sure, Rolls-Royce’s share price could keep rising in the short term. However, the lack of quality attributes suggest to me that RR is unlikely to be a good investment in the long run.

If Buffett bought small-caps…

One UK stock I do think has the potential to be a great long-term investment is dotDigital (LSE: DOTD). This is a fast-growing cloud-based software business that helps companies send marketing communications to their customers.

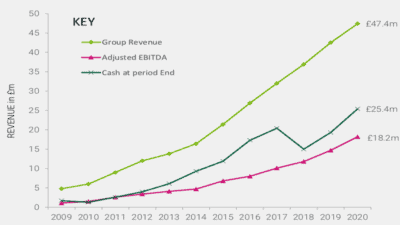

DotDigital is a really impressive business, in my view. For starters, it has a fantastic growth track record. Over the last five years, the company’s top line has climbed from £21.4m to £47.4m. Recent results, for the year to the end of June, showed a 12% increase in total revenue, with revenues in the APAC region growing 37%. Recurring revenue last year was 91%.

Source: dotDigital

Second, the company is highly profitable. Over the last five years, return on capital employed (ROCE) has averaged close to 25%. This suggests it has a competitive advantage.

Third, its dividend growth track record is excellent. Since paying a maiden dividend in 2014, it has increased its payout every year.

Finally, it has a very strong balance sheet. At 30 June, it had cash of £25m and no debt.

Unlike Rolls-Royce, dotDigital is very much a high-quality business. It’s the kind of business that has the potential, over time, to make investors a lot of money. I’ll point out that I first bought DOTD shares at around 23p a few years back and, since then, they’ve risen, slowly and steadily, to 140p.

I’ve bought more shares

But dotDigital shares aren’t cheap. Currently, the forward-looking P/E ratio is about 35. That valuation adds some risk to the investment case. However, I don’t see it as a deal-breaker. This is a high-quality company that’s growing rapidly.

After rising to 155p in October, dotDigital shares have pulled back below 140p recently. I see this pullback as a buying opportunity. Earlier in the week, I took advantage of this share price weakness and bought more shares. As I said, I think this stock has the potential to be a winning long-term investment.