FTSE 100 investors have surely had a volatile time so far this year. There was the big crash in March and yesterday there was a small stock market crash too. But the Footsie could go much lower, I think. Here’s why.

Top reasons for another stock market crash

To start with, the coronavirus-related tougher measures will delay the long-awaited economic recovery, I think. Although there won’t probably be a second lockdown like we had this spring, there will surely be more regulations. For example, bars, hotels, and restaurants will have closing time at 22:00 starting from Thursday. Clearly, this will be an additional blow for the hospitality industry. What’s more, everyone is recommended to work from home if there is such an opportunity. The fact that tighter measures are in place is also a risk to many other sectors of the economy. Airlines and cinemas will be the first to suffer, I believe.

Then, I assume there’ll be more volatility soon due to Brexit. It’s still a big question whether there’ll be a ‘deal’ or a ‘no-deal’ divorce from the EU. There are many issues the two sides still cannot agree on. So it looks like the UK will leave without a deal. Some well-established investment banks like Goldman Sachs think a hard Brexit will be even worse for the UK economy than the coronavirus lockdown. I don’t know for sure what the future holds for UK-EU relations, but I am more than sure that any bad news will lead to volatility.

US-China tensions are a great risk too. And so are the US elections, which are a major source of uncertainty as well. These last two things to worry about might seem to be irrelevant for FTSE 100 investors. However, that’s not the case, unfortunately. That’s because major stock market crashes in the UK were all somehow linked to the US economy. The most obvious examples are the dot-com bubble and the Great Recession of 2008–09.

Here’s what I’d do as a FTSE 100 investor

Earlier on I wrote about the steps I’d take as a Footsie investor. But I find the most important measure one can take is holding as much spare cash as possible. A stock market crash is usually a great buying opportunity. Always remember that markets go up and down. I don’t worry that much when my portfolio holdings go down. After all, it’s a normal situation for an investor. But I find it really annoying not being able to take advantage of situations like this. That’s why it’s extremely important to have some cash available to invest.

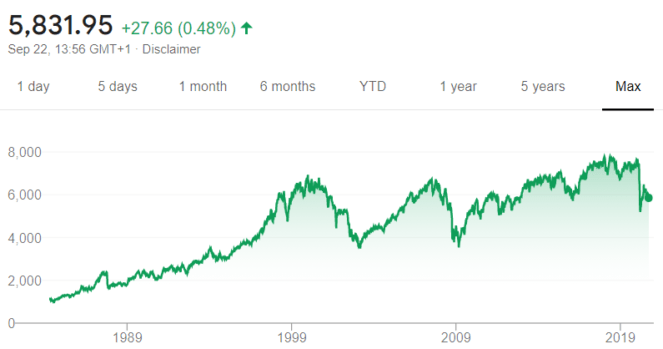

I’d recommend FTSE 100 investors to stop worrying. Instead, think about the stock market recovery record. It’s really sound. This can be seen from the graph below.

FTSE 100 history

Source: Google Finance

But obviously, it’s much better to buy soon after a major stock market crash and not just ahead of it.

FTSE 100 is an index, which means it’s just the market average. But it’s possible to consistently overperform it. We at The Motley Fool attempt to do just that with our investment ideas.