Synairgen (LSE:SNG) shares have surged to new highs in July. Today they plunged a little. If you are thinking of buying them, here’s what you need to know.

Synairgen share price surge

Synairgen is a micro-cap drug discovery company founded in 2003 with a strong focus on respiratory diseases. On 20 July, management announced positive results from the company’s Phase II drug trial for SNG001. This drug is used in treating Covid-19 patients. According to the firm’s news release, SNG001 is effective in preventing coronavirus patients from requiring ventilation.

All that sounds very good. This news even led to the stock surging by 420% in a single session. But quite recently the stock plunged by 20% as a result of profit taking.

As my colleague Rachael FitzGerald-Finch pointed out, there the company has challenges in monetising the drug. First, the effective Phase II trial doesn’t automatically mean Phase III trials will be successful. It’s usually a long way to go. Secondly, Synairgen probably doesn’t have the expertise to market and sell the drug effectively on its own. What’s more, the market for Covid-19 drugs seems to be really competitive right now.

But there are other stumbling blocks for Synairgen shares in my opinion. I’d like to look at the accounting fundamentals here.

Synairgen fundamentals

It’s always worth checking the accounting fundamentals before investing in any company. This is especially true of micro-caps, which tend to be riskier than larger companies.

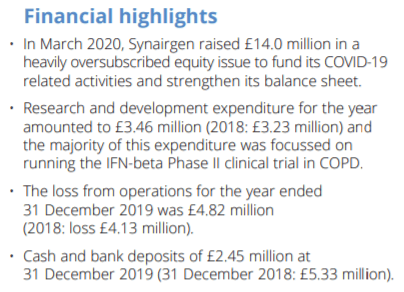

Here’s an extract of Synairgen’s annual 2019 report.

Source: Synairgen

To start with, the company’s shares were heavily diluted through a £14m equity issue. That was obviously bad for the company’s existing shareholders. What’s more, 2019 was a loss-making year for the company. The loss totalled £4.82m versus the £4.13m reported in 2018. On top of that, the cash balance plunged from £5.33m in 2018 to £4.82m in 2019. In order to get an even clearer picture, I checked the company’s balance sheet. Well, the equity (assets minus liabilities) fell from £6.03m to £2.25m. So, overall it looks like the company’s affairs got much worse in 2019. This is significant. Investing in companies with a history of improving financials is essential for minimising the risks. This doesn’t seem to be the case here.

As I mentioned above, the company quite recently announced positive drug trial news. This let to investors getting overly excited about the Synairgen shares. In turn, this made them look too expensive. Very well, I can understand paying a high price for a bright future. But is it so bright? Apart from my colleague’s concerns, I’d also add that their drugs might be bought for a limited time only. If we assume that the pandemic is over soon, there’ll be very low demand for Covid-19 drugs. Although I think it will take the effective vaccine quite a while to become available to everyone, it might happen soon enough. So, there will be far fewer patients requiring the drugs Synairgen makes.

This is what I’d do

I’d personally avoid Synairgen. It seems to be too expensive, and the fundamentals simply aren’t here. If you are looking for high-growth small caps, I’d look elsewhere.