The Boohoo (LSE:BOO) share price is down compared to its June levels. But retail sales have surged. Does this create a great opportunity to get rich?

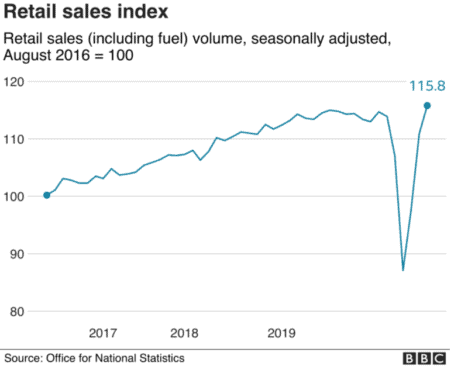

Retail sales rise in the UK

Belive it or not, UK retail sales in July exceeded their pre-pandemic levels by 3%.

Retail sales, UK

Source: BBC

But let us analyse what consumers have actually started buying. Shoppers’ interest in physical stores has risen. This has been especially true of clothing. But due to the easing of some Covid-19 restrictions, online apparel sales have dropped by 7%. In my view, it could be one of the reasons for the Boohoo stock plunge. Indeed, what’s the point of ordering clothes online if you can go out and shop in a physical store? It’s quite a challenge to online retailers, including Boohoo. But how long will it last? Many countries around the world are facing repeat coronavirus infection waves. This might lead to quarantine part 2. In theory this should lead to a rise in demand for online shopping. However, if we face another lockdown, it will be problematic for economic recovery in the long term. This will also have a bad effect on consumer spending and Boohoo sales as a result.

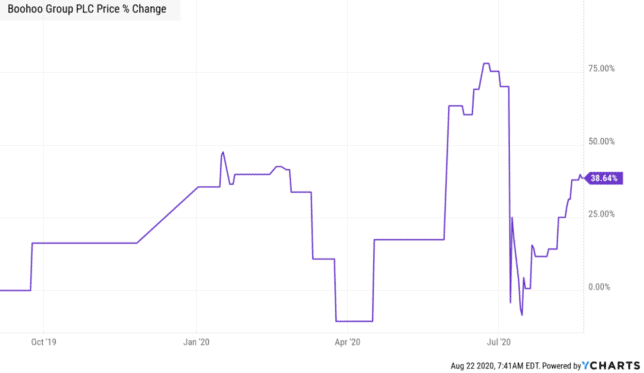

Boohoo stock plunge

But it’s not the only problem Boohoo is currently facing. As my colleague Karl wrote in his article, the online retailer also has to cope with reputational damage. In July, news broke of worker exploitation at factories where the companies clothes are made. Some workers faced poor working conditions related to Covid-19, and some were paid as little as £3.50 per hour. In reaction, the retailer’s shares almost wiped out their 75% gains.

Boohoo shares

Source: Y-Charts

But isn’t Boohoo stock a great opportunity because of the plunge?

A wonderful opportunity?

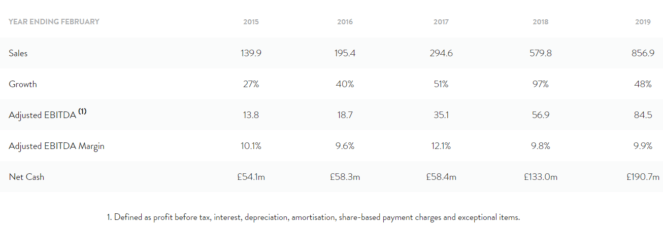

On 22 April 2020 the company reported its full-year 2019 earnings results. In my view, they were quite impressive.

Historical financial performance, Boohoo

Source: Boohoo Group

If you look at the historical performance of the group, you’ll see that its sales and EBITDA (earnings before interest, taxes, depreciation, and amortisation) kept rising. But if you look at the growth rate, you’ll see that it reached its peak in 2018. And how about the analysts’ forecasts? Well, they all expect Boohoo to increase its sales in 2021. But by how much? Well, the consensus estimate is 19%. Not impressive, given last year’s revenue rise of 48%. So far, it looks to me that the company’s fundamentals aren’t good for the growth investor.

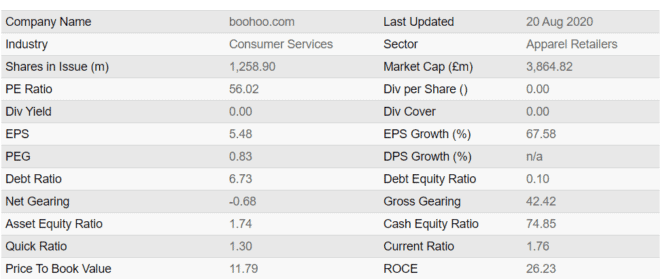

Boohoo’s accounting multipliers aren’t impressive either. That is, it looks like the company is somewhat overvalued. The price-to-earnings (P/E) and price-to-book (P/B) ratios of 56 and almost 12, respectively, look very high. The debt ratio is enormous too. What’s more, the company doesn’t pay dividends. All that isn’t very good for value investors.

Boohoo shares, fundamentals

Source: Shares Magazine

Conclusion

Online commerce is a high-growth sector. It received an even greater boost due to the lockdown. At the same time, it looks like Boohoo’s shares are overvalued and the growth rate is slowing down. Although the company is profitable right now, I’d prefer to avoid it.