In recent years, there’s been one sector of the FTSE, in particular, that I’ve been overly bullish on. Many companies in this sector have been growing at a prolific rate and generating super returns for investors in the process.

After the recent stock market crash, I’m now even more bullish on this sector. In my opinion, the disruption the world has experienced recently due to Covid-19 could speed up the adoption of products and services offered by companies that operate in this sector. This could potentially power returns for investors for years to come.

This FTSE sector is booming

The sector of the FTSE I’m talking about, of course, is technology. As the world has been forced to go into shutdown mode in the last few months, it’s tech companies that have really shone. Just look at some of the areas of technology that are booming in the wake of the coronavirus:

-

Online shopping. One thing we’re doing a lot more of right now is online shopping. Whether buying groceries or sweatpants, we’re turning to the internet for shopping.

-

Remote working. With the world in lockdown, many of us are working from home. This is increasing demand for cloud technology as well as communication and collaboration solutions.

-

Cybersecurity. With so many people working from home (and often using their own computers and laptops), cybercrime is on the rise. This is boosting demand for cybersecurity solutions.

-

Video gaming. Due to social distancing measures, this is a dominant source of entertainment for many people right now.

Massive growth potential

This could be just the beginning of the growth story though. As my colleague Malcolm Wheatley said recently, a sustained period of lockdown is likely to “leave a lasting impression on both business behaviour and consumer behaviour.” In other words, Covid-19 could potentially turbo-charge the digital revolution.

Research certainly suggests that the outlook for this FTSE sector is favourable.

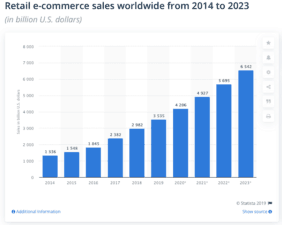

For example, just look at the forecasts for online shopping sales. Today, worldwide online retail sales amount to around $4.2trn. Yet with more and more people accessing the internet, and advances in technology making it easier to shop online, analysts expect sales to soar to a staggering $6.5trn by 2023.

Source: Statista

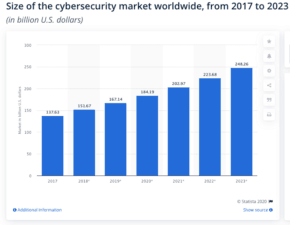

Similarly, the cybersecurity market is predicted to keep booming. In an increasingly digital world, cybercrime is becoming more and more of a problem.

Source: Statista

How to invest in FTSE tech stocks

If you’re a UK investor, the thing to understand is that there are not many tech stocks within the FTSE 100 index. There is a handful, including the likes of Experian, Sage, Aveva, and Ocado, but overall, the FTSE 100 is underweight in this area.

Don’t worry though. There are plenty of high-growth tech stocks listed outside the FTSE 100. For example, in the FTSE 250, there’s Softcat and Computacenter, which both help businesses with technology solutions. There’s also cybersecurity specialist Avast.

In the FTSE AIM 100, there are a number of exciting tech stocks. A few of my favourites include digital identification specialist GB Group, video game specialist Keywords Studios, digital marketing company dotDigital. I also like online retailers ASOS and Boohoo.

There are plenty more exciting tech companies I could name. Do your research, and I think you could potentially see some big profits in the years ahead.