It is possible to become a Stocks and Shares ISA millionaire. Investors shooting for a seven-figure portfolio need to save regularly and earn a decent return. The most important factor for building a million-pound portfolio, however, is time. Starting saving as soon as possible is the best thing a budding millionaire investor can do.

Stocks and shares

The ISA deadline of 5 April is fast approaching, and many investors might be scrambling to make the most of the current annual £20,000 contribution limit. It is no bad thing to save as much as possible, and perhaps the looming deadline will prompt investors who have been delaying to start investing. However, I have found that a regular savings plan beats investing a lump sum. Once this year’s allowance has been taken advantage of, it is important to take regular slices of the next, and so on.

Some investors may be shying away from the stock market altogether, given the recent crash. This is a mistake. Stocks and shares have historically outperformed both bonds and cash, and a decent return on investment will make a million-pound portfolio more likely.

The longer the investment horizon and the higher return, the more annual taxes consume investment gains. Given that a million-pound portfolio will typically take a long time to build even with a high rate of return, an ISA account is perfect for the job. ISA accounts offer tax-free savings, even for stock investments and the capital gains and dividends they offer.

Now, stock market investments are riskier than cash or bonds. But a regular investment plan carried out over a long time horizon will help smooth out the volatility in the stock markets, by buying when stocks are falling (getting cheaper) and rising (becoming more expensive).

Making a million

According to the Office for National Statistics, the median after-tax monthly household income in the UK was £2,450 in 2019. The FTSE 100 has returned 8.3%, including dividend reinvestment, on average over the last 10 years. Over 25 years, the average FTSE 100 return has been 6.4%.

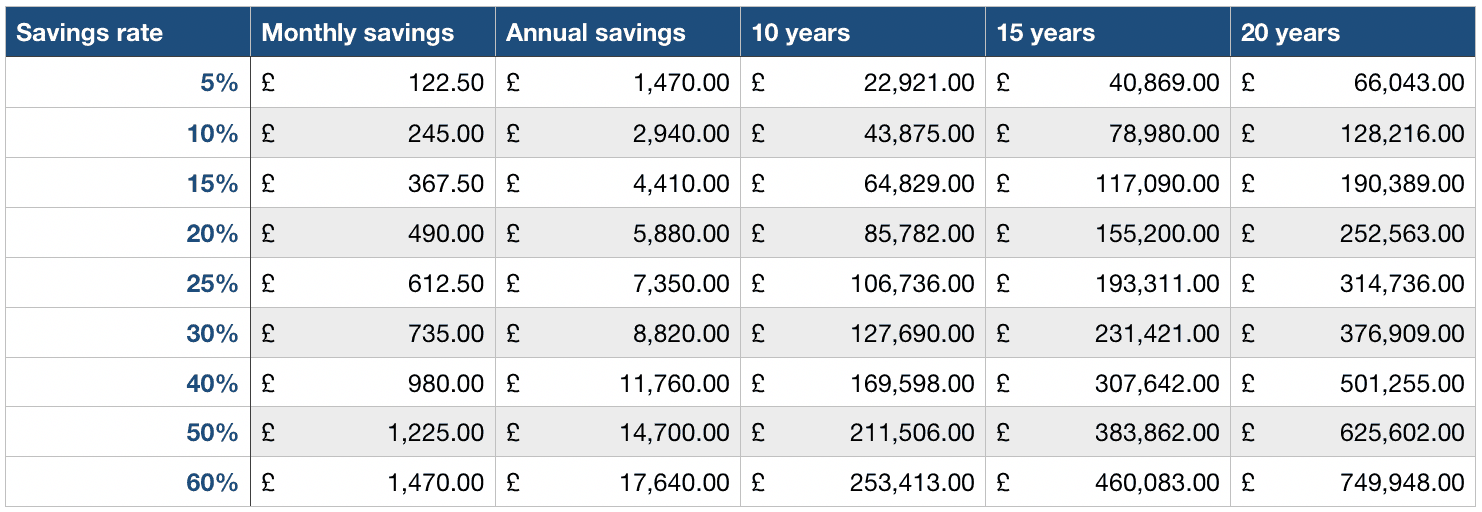

Let’s assume a £1,000 initial investment, and a long-term average annual return of 7%. Over time different amounts of wealth can be built up, depending on how much is saved each month:

It might be disappointing that see that saving 60% of the median household monthly income with a 7% annual return does not net a million-pound portfolio. However, £750,000 is a significant amount of money and could provide a substantial degree of financial freedom. Saving a bit over £100 a month could grow to over £66,000 in 20 years. That is a decent-sized pot that could supplement a pension nicely.

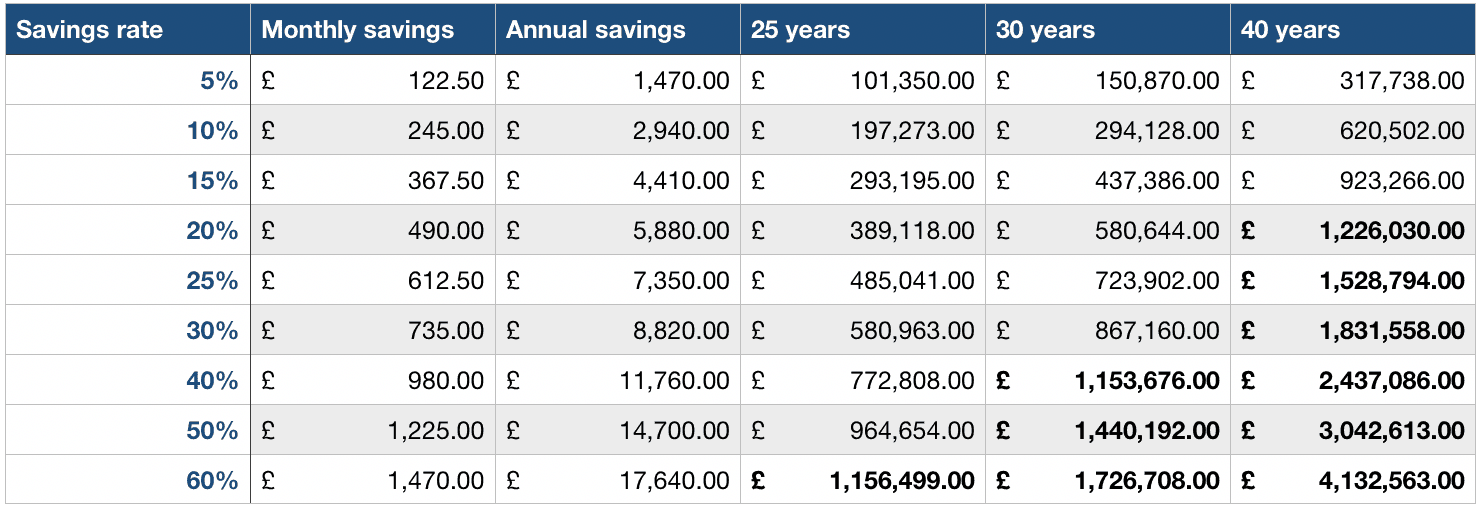

If an investor has 25 years or more, then million-pound portfolios are possible:

Investing for 40 years might sound fanciful, but it is possible for someone starting in their early twenties, or even thirties if retirement is delayed. Another point worth mentioning is that £980 a month might be out of reach at the moment, but that’s no reason to delay starting. Once mortgages get paid off or children leave the nest, it may be feasible to save £950 or another previously unthinkable amount each month.

Although becoming a Stocks and Shares ISA millionaire is possible, other amounts may look more achievable. Whatever the amount, the only way to get there is to start investing. Right now is as good a time as any.