The FTSE 100 dropped over 3% yesterday. Today it is down by another percentage point. In times like these, the question of whether buying dips in the market beats regular investing often gets asked. The answer may appear obvious. After all, buying dips means buying cheap. Regular investing could mean buying just before a dip or when the market is expensive. Should investors not aim to buy low and sell high?

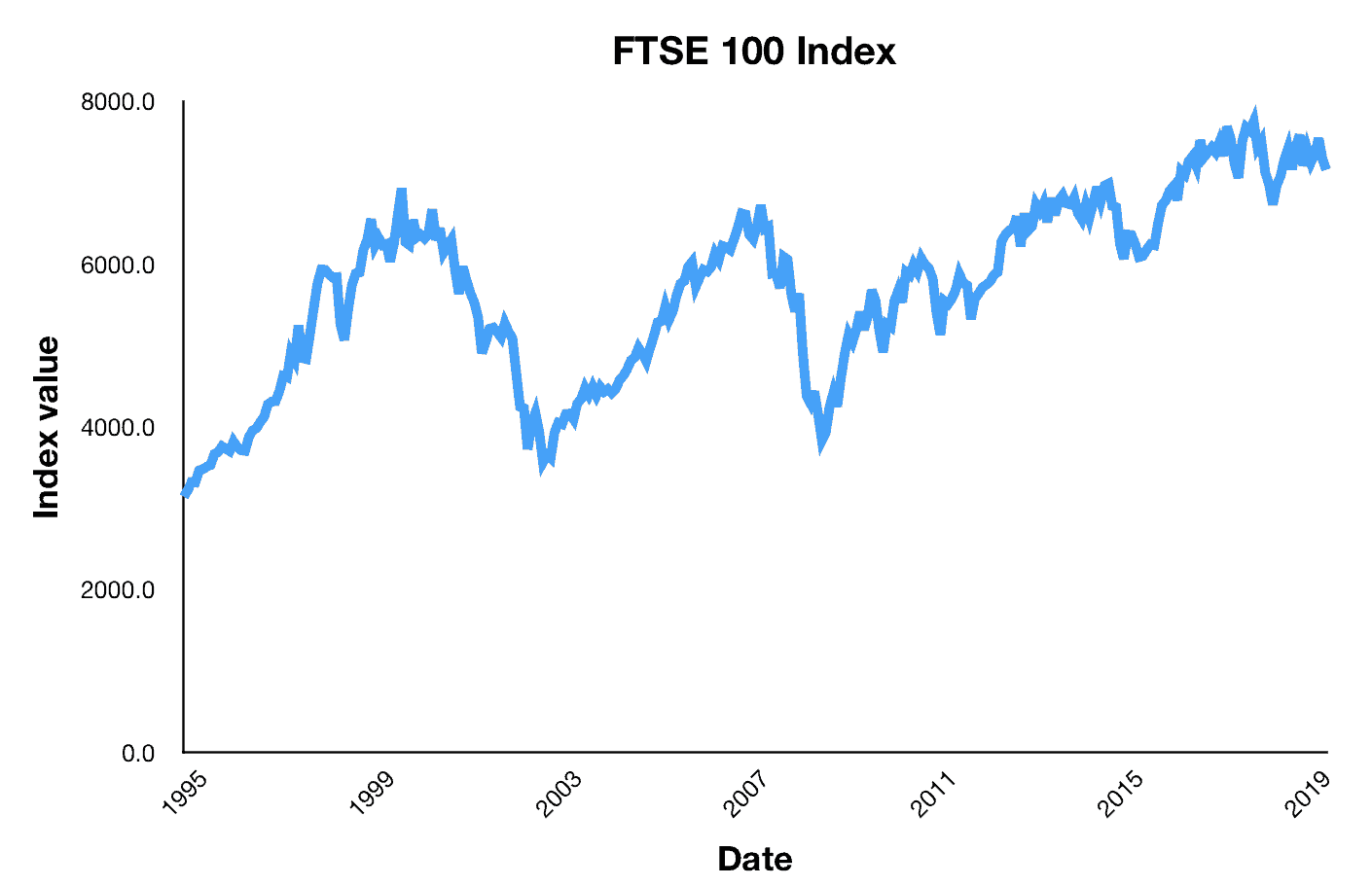

A strategy of buying low and selling high makes intuitive sense, especially when we look at the performance of the FTSE 100 index.

But the chart above shows the price of the index only. It does not account for the dividends that are paid by the companies in the index. The average annual dividend yield on the FTSE 100 from June 1993 to November 2018 was 3.47% or about 0.28% per month.

An investor in the FTSE 100 will receive these dividends if they buy all 100 stocks themselves or a fund that tracks the index. If dividends are being reinvested then the performance of the investment will not look like the chart above.

Dipping in

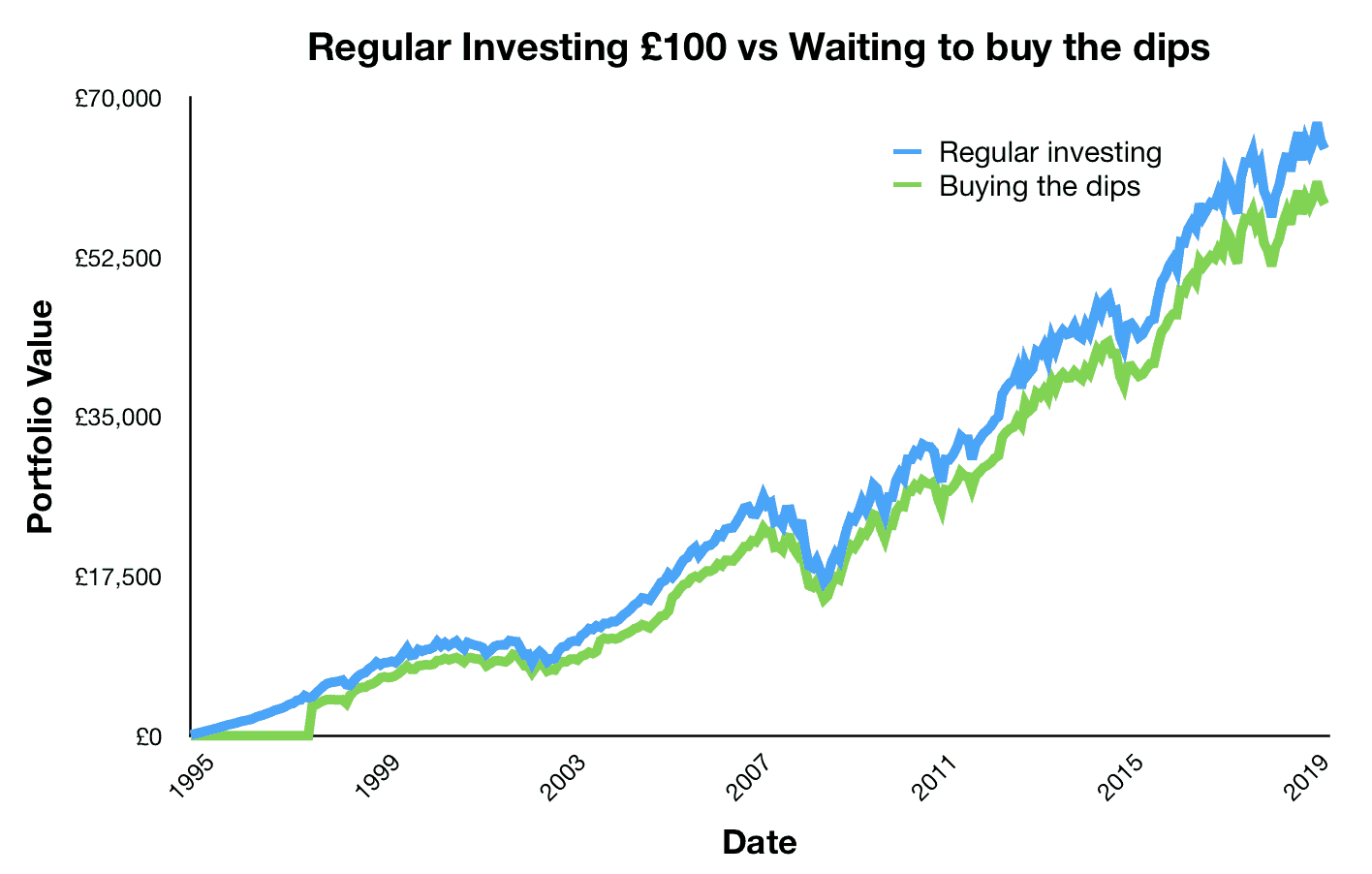

Let’s compare the two strategies. First, we will invest £100 every month in the FTSE 100 starting in March 1995 and finishing in January 2020. Second, we will look at a strategy of investing after the price of the FTSE 100 has fallen at least 5% in a month. To keep the total invested amounts similar, in the second strategy, £100 is either invested or banked until the index has fallen by 5%.

In total of £29,800 gets invested buying the dips and £30,000 in regular investments over the 25 or so years. How about the performance of the two strategies? Well, the regular investor ends up with £64,359 compared to £58,270 for the dip buyer.

Along for the ride

Of the two strategies, regular investing comes out on top. The message is clear, don’t wait to buy the dip, just keep investing. The more time you are in the market, the more your money grows, assuming dividends are being paid and reinvested. The more you try to time the market, the less time your money has to grow.

I used data for the entire FTSE 100 for this exercise. There are some stocks that have higher dividend yields than the 3.47% average, so a diversified portfolio of those could have done even better.

Also bear in mind that this experiment was carried out with 25 years of monthly returns. The longer your investment time horizon, the more likely you are to do well. Looking back over the FTSE 100 price chart should make this point clear. If you only had two or three years to invest and you started around 1999 or 2007 you would have done badly. Long-term investing is the key to success.