One of the most challenging aspects of retirement planning is working out how much income you’ll actually need. Ultimately, it comes down to what type of lifestyle you’re planning to live in your later years and whether you’re planning to live frugally, or live it up.

To help those retirement planners determine post-work income requirements, the Pensions and Lifetime Savings Association (PLSA) has put together a new set of ‘retirement living standards’, which details roughly how much money you need per year for different retirement lifestyles. Here’s a look at how much annual income the trade association believes is needed.

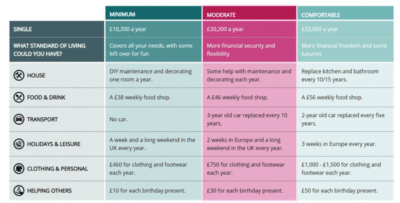

Single person income requirements

The PLSA believes that in order to live a ‘minimum’ lifestyle, a single person requires income of around £10,200 per year. This would cover all basic needs, with some money left over for ‘fun’, apparently.

However, if that person wanted to live a ‘moderate’ lifestyle, they’d need nearly twice that – £20,200 per year. This kind of lifestyle would provide more flexibility. To actually live a ‘comfortable’ lifestyle, a single person would require annual income of around £33,000. This would provide for luxuries such as multiple trips to Europe each year.

Source: The Pensions and Lifetime Savings Association

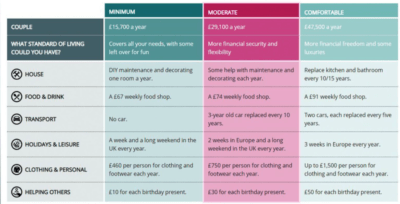

Couple income requirements

For couples, retirement income requirements are different because costs can be shared. Here, the PLSA believes that to live a minimum lifestyle, a couple need income of around £15,700 per year while, for a moderate or comfortable lifestyle, £29,100 and £47,500 is required, respectively.

Source: The Pensions and Lifetime Savings Association

So, what are the takeaways here?

The State Pension isn’t enough

One key takeaway is the State Pension isn’t enough to provide a single person with even a minimum lifestyle. At £8,767 per year currently, it’s well short of the £10,200 that’s needed to live a basic lifestyle as a single person.

If a couple were both entitled to the State Pension and were receiving £17,534 in income per year from the government, they may be able to get by. That’s more than the £15,700 annual income that the PLSA says is required for a couple to live a basic lifestyle. However, if that couple wanted to live a moderate lifestyle, the State Pension would be very much inadequate – the couple would need nearly 70% more income.

Act now before it’s too late

Overall, these new retirement living standards are a reminder of just how important it is to plan and save for retirement. In most situations, the State Pension will not be enough to live a comfortable lifestyle. As such, it’s crucial to think about your retirement income needs ahead of time and start building up a retirement pot as early as possible. The sooner you start saving for retirement, the more chance you’ll have of living a comfortable lifestyle in your later years.

If you’re looking to learn more about saving and investing for retirement, you’ve come to the right place.