Building wealth by investing really isn’t that hard. Anyone can do it, no matter what they earn. That said, if your goal is to get rich through investing, there are a number of fundamental concepts that you need to understand. Get these right, and the rest often tends to take care of themselves.

Compounding

Let’s start with compounding. If I had to list the single most important concept to understand when it comes to wealth generation, this would be it. Put simply, it’s the secret to getting rich.

Compounding refers to the process of earning interest on your interest, or earnings on your earnings. The reason that compounding is so important when it comes to building wealth is that if you can compound your money by continually reinvesting your earnings, your money will grow at an exponential rate.

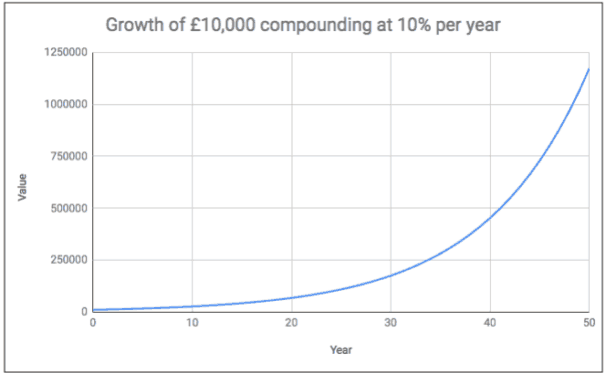

Just look at the chart below which shows how £10,000 grows when it’s compounded by 10% per year. In the first year, the gain is only £1,000. Yet by year 50, the gain is over £100,000 per year. That’s the power of compounding.

Ultimately, the sooner you begin compounding your money, the more wealth you can generate.

Risk and return

Next, it’s critical to understand that in the financial world return is directly proportional to risk. So, if you want to generate a healthy return on your money, you will have to take a degree of risk. This means investing in higher-risk assets such as stocks.

Many people don’t like taking any risk at all with their money, so they leave it sitting in a Cash ISA earning 1%. That’s fine, but it makes the process of building wealth extremely difficult as inflation actually erodes the value of the money over time.

The bottom line is that unless you’re earning an astronomical salary, investing your money in growth assets, which are higher risk than cash savings, is the best way to generate wealth over the long term.

Capital preservation

Finally, the third vital concept to understand is that of capital preservation. If your goal is to build your wealth significantly, it’s important to have sound risk management processes in place so you don’t lose too much money on any one investment. As Warren Buffett says in relation to investing: “Rule No. 1: Never lose money. Rule No. 2: Don’t forget rule No. 1”.

Losing vast amounts of money can really set you back. That’s because when you do, you have to make much more, percentage-wise, just to break even. For example, if you lose 50% on an investment, you have to make a 100% return just to break even. Lose 80% on a stock, and you need a 400% return to make it back to square one.

Perhaps the easiest way to lower your overall portfolio risk and reduce the chances of losing a lot of money is to diversify your capital across many different asset classes, sectors, stocks, and geographic regions. This way, if one asset struggles, it shouldn’t impact your overall returns too badly.

Investing doesn’t need to be complex. But you do need to get the basics right. Focus on the three concepts I’ve discussed above, and it will make the process of building up your wealth far easier.