Last week, I made a change to my self-invested personal pension (SIPP), selling out of Neil Woodford’s Equity Income fund. Here’s a look at why I sold, and what I did with the proceeds.

Poor performance

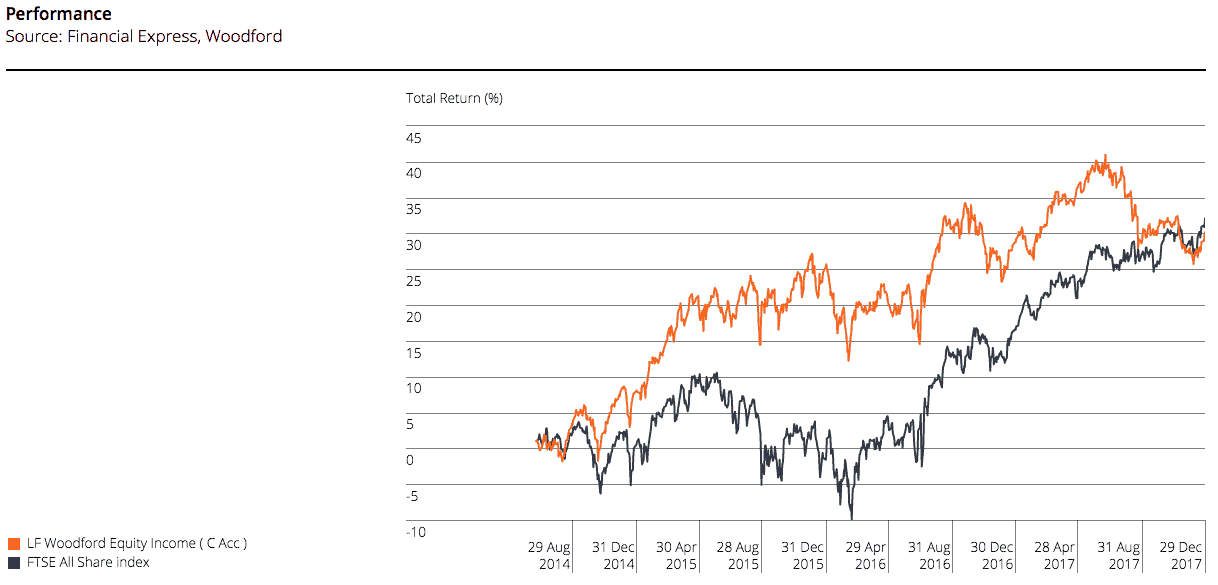

I bought Woodford’s flagship fund for my pension back in September 2014, not long after it launched. For a while, I was very happy with the performance of the fund. For example, in 2015, the portfolio returned 16.2%. This was comfortably in excess of the FTSE All-Share index’s return of just 1%

Source: Woodford Investment Management

However, since then, Woodford’s performance has been pretty poor. In 2016 and 2017, the fund returned just 3.2% and 0.8%. In the same time, the index generated returns of 16.8% and 13.1%. That’s quite some underperformance.

While a performance like that is disappointing, it’s actually not the reason I sold the fund. Every portfolio manager will experience a challenging period at some stage or another. As a long-term investor, it doesn’t make sense to bail out of a fund just because short-term performance has been below par. Chasing the best performing funds is a dangerous strategy that can backfire. So why did I sell?

Equity income?

The reason I sold Woodford’s marquee fund is that the portfolio’s composition has changed dramatically since launch.

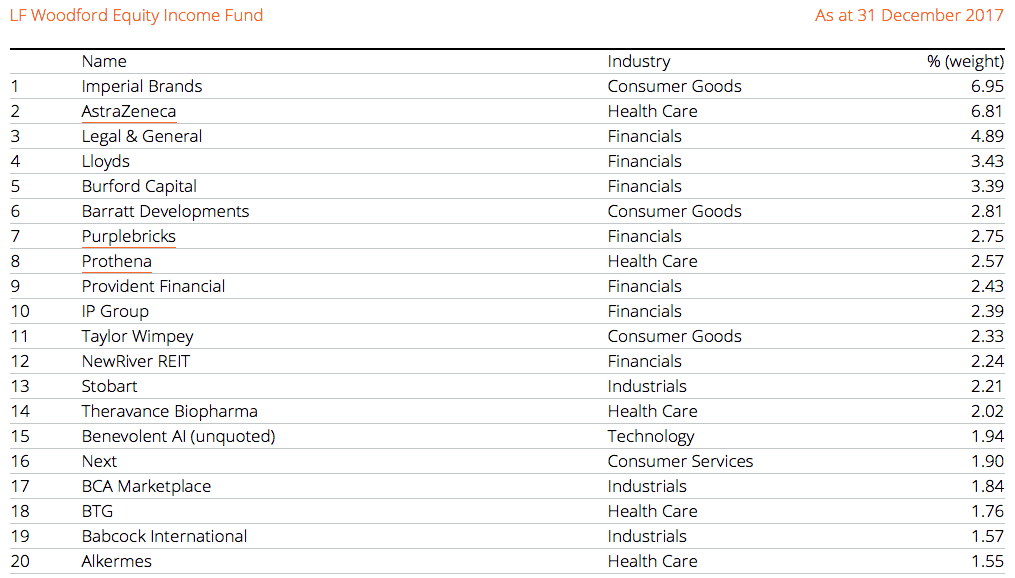

As an ‘equity income’ fund, I would expect it to hold a large number of blue-chip companies that have strong dividend track records. That’s the general approach to the investment strategy. And back in 2014, when it launched, it did contain a large number of these stocks. For example, the majority of the top 20 holdings were well-recognised FTSE 100 names, such as HSBC Holdings, BAE Systems, British American Tobacco and Reckitt Benckiser.

However, a glance at the portfolio’s top holdings today reveals a completely different story. If you strip out the top four holdings, the portfolio contains a very unorthodox list of names for an equity income fund. For example, online real estate agent Purplebricks, the seventh largest holding, is a company that is not yet making a profit and not paying a dividend. Similarly Prothena, the eighth largest holding, is a biotechnology company that does not pay a dividend.

Source: Woodford Investment Management

Ultimately, I sold Woodford’s fund because it no longer represents the investment style I was looking for in my SIPP.

Fund switch

After selling Woodford’s fund, I invested the proceeds in the J O Hambro UK Equity Income fund. This appears to be much more of a traditional equity income fund. For example, the top 10 holdings include names such as Royal Dutch Shell, HSBC, Rio Tinto and Aviva. Over the last three calendar years, it has returned 18.1%, 16.8% and 1%. The ongoing fee is just 0.67% per year on Hargreaves Lansdown’s platform.

Woodford’s performance could bounce back this year, but given that the focus of my SIPP is on secure, steady growth, I’m a lot more comfortable holding the more traditional offer run by J O Hambro.