Trying to find stocks that you can buy and hold for the next two, five, or even 10 years is a tough process. You’ve got to be sure that the company you pick has a durable business model and a long-term plan for growth. If these traits are in place, you can be sure the company can continue to churn out returns for many years to come.

Photo-Me (LSE: PHTM) might not seem like a long-term buy at first glance, but over the past decade, the company has proven that it can adapt to market changes and at the same time, keep shareholder returns high.

Changing with the market

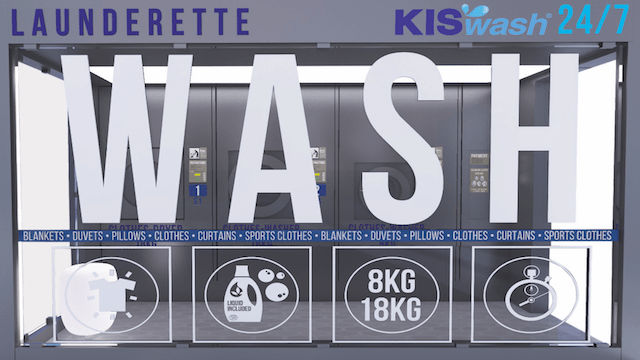

Photo-Me is best known for its photo booths that take and print passport-sized photos. However this business, which once produced a relatively stable and consistent income for the firm, has been shrinking as camera phones have become mainstream. To combat this change, management has expanded into other business lines such as laundry and photo kiosks.

Today, as well as the photo identification business, Photo-Me owns and operates 1,965 laundry units across 12 countries and over 5,000 printing kiosks across Europe. These offer services such as photo printing, money transfer, gift cards and selfies.

These changes have helped push profits to a record £48m and the firm has now recorded four consecutive years of double-digit earnings growth. The company is planning to roll out thousands more of its laundry units and kiosks as well as investing in new tech to stay ahead of the game, which should continue to drive growth. City analysts have pencilled in earnings per share growth of 5% for 2017, followed by 6% for 2018.

Alongside its steady growth, its other attractive quality is the dividend yield. Management has decided to return the majority of cash generated from operations to shareholders and the shares currently support a yield of 5.3%, rising to an estimated 5.7% for 2018. This dividend is backed up by a net cash balance of nearly £40m.

Income from bricks and mortar

Persimmon (LSE: PSON) also looks to be a solid long-term buy. As one of the UK’s largest homebuilders, the firm is well placed to meet the country’s ever growing demand for housing. Meanwhile, management has learned the lessons of 2007, and the business is committed to maintaining a strong balance sheet and not overextending itself.

Instead of trying to grow too fast, or overextend, Persimmon is returning excess cash to shareholders. Even though some politicians might disagree with the company’s decision to return cash to investors rather than invest in new properties, it makes a lot of business sense. Land prices are rising and it would be irresponsible for Persimmon to pay over the odds just to increase its output.

According to City analysts, based on Persimmon’s cash return plans, the shares are set to yield 5.2% for 2017 and 2018. Future payouts are backstopped by a cash balance of £1.1bn (30 June), which is more than enough to fund both Persimmon’s growth and dividends. Based on current City estimates, shares in the group trade at an attractive forward P/E of 10.8.