The FTSE 100 may have pulled back slightly since Theresa May’s snap general election announcement on Tuesday but valuations across London’s main index are still looking stretched to me. That’s why I’ve been digging into the mid and small-cap indices to find great shares that still trade at reasonable valuations. And I think I’ve found one in fast growing alcohol distributor and retailer Conviviality (LSE: CVR).

A highly reliable industry

Despite rising over 40% in the past year, the company’s shares still trade at a relatively reasonable 14.5 times forward earnings and offer a solid 3.8% dividend yield, all while analysts forecast double-digit earnings growth for this year and next.

These forecasts seem eminently achievable for Conviviality given the company’s high levels of organic growth and big recent acquisitions that have consolidated its position in the alcohol distribution market across the UK. In the half year to October, the company’s revenue rose 4.4% on a like-for-like basis while acquisitions boosted the top line 211% year-on-year and led EBITDA to improve by 252%. Even more impressively, the acquisitions didn’t stretch the balance sheet and in fact lowered net debt to £138m, or 2.19 times EBITDA.

As these acquisitions are integrated the company expects significant synergies due to lower costs and improved pricing power that comes from serving over 25,000 restaurants, bars and hotels. This means margins, cash flow and earnings should all rise in the coming quarters.

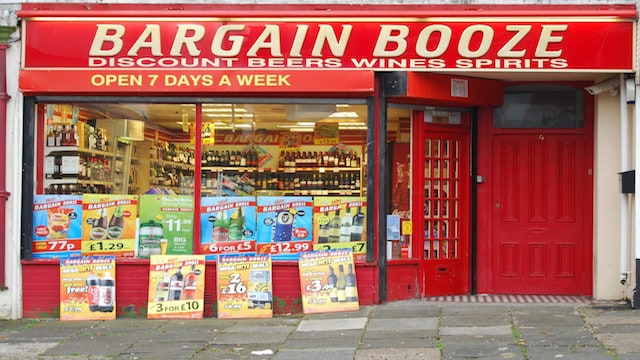

On top of the fast growing distribution business the company also has 716 franchised stores operating under the Bargain Booze and Wine Rack brands. In H1, sales from these outlets rose 2.5% year-on-year reflecting consumers shift towards shopping at small local stores and looking for value.

With good growth in both major business lines, significant cost-cutting potential, well covered dividends and an attractive valuation I believe Conviviality is one growth share investors should keep an eye on.

A riskier option

Another retailer this is growing nicely, offers a solid dividend and trades at a reasonable valuation is pawnbroker H&T (LSE: HAT). The company has recently been shrinking its estate by closing unprofitable stores, which has helped increase earnings by double-digits in each of the past two years.

And although analysts are forecasting earnings increases of 8% and 20% in the next two years respectively, the company’s shares still trade at only 13.5 times forward earnings and bring a 3% yielding dividend.

Even though shrinking the number of stores may seem an odd way to grow, it is working well for H&T as it has allowed management to concentrate on adding additional services such as foreign exchange, online personal loans and electronics buybacks that have proved popular with consumers and profitable. Rising gold prices have also helped boost margins, but while very nice, this is a volatile and unpredictable source of profits in the long term.

The company is also benefitting from increased regulatory scrutiny of the sector by the FCA. This is increasing compliance costs for smaller competitors, which they will have to pass on to competitors. However, large players such as H&T will be able to absorb these costs and expand market share.

H&T is growing nicely, improving margins, maintains a very healthy balance sheet and has plenty of room to increase already substantial dividends. With it shares trading at an attractive valuation, risk-hungry investors may want to take a second look.