This article originally appeared on Fool.com

WASHINGTON, DC — It’s taken 2 years to get back to this point. After peaking in September 2012 at approximately $705 (pre-split), Apple (NASDAQ: AAPL.US)) has now climbed all the way back after its prolonged pullback to fresh all-time highs. Shares have now traded over $105, the equivalent of $735 pre-split.

Naturally, with shares back to all-time highs investors are now wondering if it’s too late to get in, or if they can still buy Apple. Let’s take a look.

Word on the Street

For starters, let’s consider the Street’s opinion on Apple. According to Yahoo! Finance, the average price target for Apple is $115, which represents about 10% upside from here. That may not seem like a lot, and it’s also a modest hurdle for the S&P 500 to clear in the next year, which determines if Apple were to outperform or underperform should it hit that average price target.

The high price target is $143. After giving up the Street high target temporarily, Cantor Fitzgerald analyst Brian White is back at the top of the list. White seems to always want to have the Street high price target on Apple, and reclaimed his title from JPM Securities analyst Alex Gauna earlier this month. The low price target is $60, but we’ve already covered how silly that sounds.

For the most part, the Street remains bullish overall, suggesting that it’s not too late to buy.

Apple pays

Re-initiated in 2012 after a 17-year hiatus, Apple’s dividend continues to climb higher as the company remains committed to returning its copious amounts of cash to shareholders. While the majority of Apple’s capital return program is being allocated to share repurchases, its still paying out hefty amounts of cash in the form of dividends.

Apple increased its quarterly payout by 15% in early 2013, following up with an 8% increase earlier this year. The Mac maker usually updates its capital return program in March or April, which is likely when investors will find out more about the next dividend boost.

Importantly, Apple’s dividend is sustainable — its dividend payout ratio has averaged 30% since bringing its dividend back.

Source: SEC filings and author’s calculations. Fiscal quarters shown.

There’s no magic number when it comes to payout ratios, but generally investors prefer a figure in the 30% to 60% range. A payout ratio that’s too low may have investors asking for more, while a ratio that’s too high could potentially suggest that the company is being toogenerous and a dividend cut could be in the cards.

At current levels, Apple’s dividend represents a 1.8% yield. That’s less than some fellow tech giants like Microsoft and Intel, both of which yield around 2.7% right now, but it’s still a respectable yield nonetheless. There’s something for income investors here too.

Apple buys (itself)

As mentioned, the other aspect of Apple’s capital return is its massive share repurchase authorization, which currently sits at $90 billion. This is where Apple has been focusing most of its capital return efforts, believing shares remain cheap.

It should be telling that Apple just embarked upon its fourth accelerated share repurchase program while shares are at all-time highs. That’s literally Apple telling you that it thinks its shares are cheap at current prices and putting its money where its mouth is — because it’s also repurchasing shares itself. While many companies have rather bad timing with repurchases, it’s hard to argue that Apple is overpaying for itself when it’s trading at just 16 times earnings (a discount to the S&P 500).

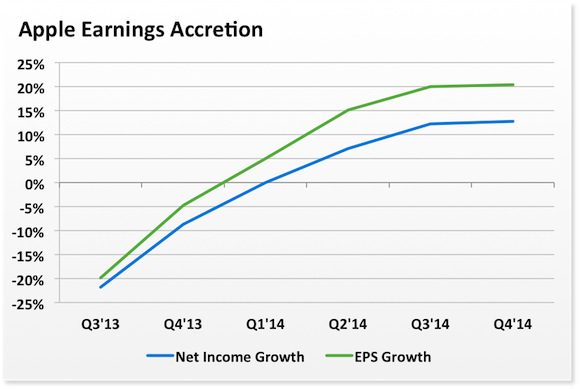

Thanks to the resulting earnings accretion, EPS growth has been continuously outpacing net income growth by a healthy margin.

Source: SEC filings. Fiscal quarters shown.

Considering the sheer magnitude of Apple’s repurchase program, it’s also worth noting that share repurchases can drive capital appreciation. As Apple continues to amplify EPS growth through aggressive repurchases, its earnings multiple will contract (all else equal) due to a larger denominator.

If Apple’s earnings multiple contracts, shares look even cheaper, which creates buying interest. If the market is willing to simply maintain Apple’s earnings multiple, then that requires prices to go higher still.

An all-time record quarter is around the corner

Apple’s guidance for the current quarter is mind-boggling. The roughly $14.4 billion that the company expects to make over the holidays is well above what any other company in the S&P 500 is capable of producing, including oil companies. As Apple has just dramatically broadened its addressable market by launching larger iPhones (opening up a whole new world of potential Android switchers), Apple could very well have another blowout quarter up its sleeve. The iPhone and Mac businesses are as strong as ever, and the iPad’s recent woes are possibly temporary hiccups.

When the company releases its fiscal first quarter earnings in January, the figures could potentially be a positive catalyst as the quarter is expected to set new all-time records in both top and bottom lines. Shortly thereafter, Apple Watch will ship, potentially boosting investor confidence (and share prices) further.

Yes, you can still buy Apple.