It’s no secret that Fundsmith portfolio manager Terry Smith likes to invest in high-quality companies. Take a look at a Fundsmith factsheet, and you’ll find Smith’s investment criteria laid out quite clearly.

However, what seems to go unnoticed, is just how well Smith has constructed the Fundsmith portfolio to take advantage of a number of powerful trends that are likely to have a huge impact on the world in the years ahead. Having analysed the holdings, here are four dominant trends I believe the global equity fund is well placed to capitalise on.

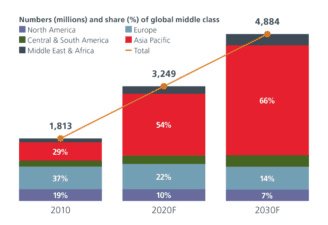

Rising wealth in the emerging markets

The first trend that I think Fundsmith should benefit from is rising wealth across the world’s emerging markets. As disposable incomes in developing countries increase, consumers are likely to desire products that will improve the quality of their lives. They are also likely to ‘trade up’ to well-known brands.

Source: Prudential

In this respect, Fundsmith looks very well placed to capitalise. Holdings that could benefit include consumer goods champion Unilever, alcoholic drinks maker Diageo, soft drink legend PepsiCo, and cosmetics giants L’Oréal and Estée Lauder – all of which have exposure to the emerging markets.

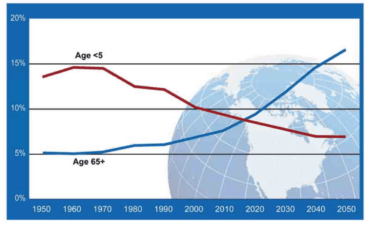

The world’s ageing population

Fundsmith also looks well placed to profit from the world’s ageing population. As people age, their demand for healthcare products and services tends to rise. This means the healthcare sector should do well in the years ahead.

Source: World Health Organisation

Here, the fund has exposure to a number of leading companies such as Coloplast, which makes healthcare products related to ostomy, continence, and wound care, Stryker, which specialises in joint replacement implants, as well as Johnson & Johnson and Reckitt Benckiser, which both own a number of well-known healthcare brands.

The diabetes ‘epidemic’

Taking the healthcare theme one step further, it’s worth noting that Fundsmith also has exposure to a number of top diabetes stocks including Novo Nordisk and Becton Dickinson and Co.

This is a smart move by Smith, as the prevalence of diabetes is growing at an alarming rate. Since 1980, the number of people with diabetes globally has nearly quadrupled to over 420m, and experts predict that by 2045, more than 600m people could be affected by the disease due to the ageing population and increasingly unhealthy lifestyles. Looking at this forecast, demand for diabetes treatment is likely to increase.

A more digital world

Finally, Fundsmith looks very well positioned to benefit from an increasingly digital world. Not only does the fund hold one of the world’s biggest players in artificial intelligence in Microsoft (which recently won a $10bn cloud contract with the Pentagon) but it also holds one of the major players in the digital payments space, PayPal. In addition, it holds Spanish IT specialist Amadeus, which provides technology solutions to the travel industry, as well as Sage and Intuit, which provide cloud-based accounting solutions to businesses.

Overall, from a thematic investing point of view, I think Fundsmith looks very attractive. Of course, my analysis is based on its current holdings. These could change in the future. However, given that Smith is a long-term investor, I expect the fund manager to hold on to many of the stocks I’ve mentioned above for a while.