If you’re new to investing, you may have heard the term ‘yield curve’. But what does it mean? Why is it important? And what do changes in the curve tell you? I take a look.

What does ‘yield curve’ mean?

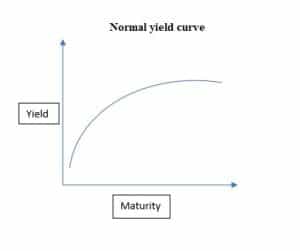

A yield curve allows investors to compare similar investments with different maturity dates as a way to balance risk and return. Simply put, it is a line graph of how investments accrue interest and mature over time.

Since it’s also possible to see how interest rates behave differently based on maturity, you can measure investment risks. You can also get an insight into interest rates. This can help you gauge the economy’s direction and when to invest.

Though you may come across different yield curves representing different investments, the one mostly referred to as ‘the yield curve’ reflects yields on UK government bonds (also known as gilts). This yield curve allows you to picture the risk and potential returns represented by gilts.

In the graph, the vertical axis represents the gilt’s yield, and the horizontal axis represents time to maturity.

What are the three types of yield curve?

The yield curve may take different shapes at different points in the economic cycle, but it is typically upward sloping. This is because lower yields are usually associated with shorter maturity dates and higher yields with longer maturities.

There are three distinct shapes:

- Upward-sloping or positive

- Downward-sloping or inverted

- Flat

Let’s take a closer look.

Upward-sloping or positive

As indicated earlier, this yield curve occurs when yields of shorter maturity dates are lower than yields of longer maturities.

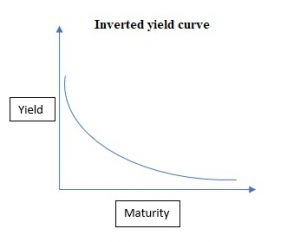

Downward-sloping or inverted

This yield curve occurs when yields of longer maturity dates are lower than yields of shorter maturities. This is mostly when investors expect economic growth to slow and could be a sign of a recession.

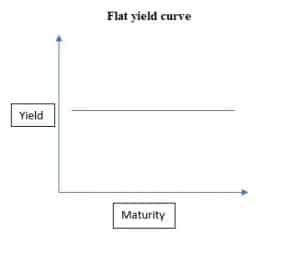

Flat

A flat yield curve results when yields of short and long maturity dates are considered equal. It mostly occurs during a transition between the normal and inverted yield curves.

Why is the yield curve important?

Wrapping your head around the concept of yield curves can help you gain a better understanding of:

- How your investment will work for you

- How different rates of interest behave over time

- Risks associated with investments

- The broader economy in which businesses operates

Keep in mind that while changes in the shape of the yield curve can be informative, they don’t necessarily translate to taking action. You may need to consider other factors like time horizons and risk tolerance.

What affects the yield curve?

Gilts are probably the safest form of investment, owing to the depth of resources of the UK government. When the economy is not favouring investors, they’re more interested in gilts. An increase in demand for gilts pushes prices up and causes the yield to reduce.

When investors feel better about the economy, they are less interested in gilts and buy riskier investments with higher returns. The government raises the yield on gilts to balance supply and demand, which attracts investors. This also happens when inflation increases and leads to a decrease in purchasing power.

Additionally, when inflation increases, you can expect the Bank of England to raise the base rate to reduce the money supply. The demand for gilts increases, and eventually interest rates reduce.