One UK growth stock that’s been getting a lot of attention this week is Kanabo Group (LSE: KNB), which listed on the London Stock Exchange (LSE) on Tuesday. Yesterday, KNB was the second most viewed stock on Hargreaves Lansdown.

Is this a growth stock I should be considering for my own portfolio? Let’s take a look at the investment case.

Kanabo Group: what does it do?

Kanabo is an Israeli medical cannabis company focused on the distribution of cannabis-derived products for medical patients, and non-THC products for CBD consumers. It listed on the LSE through a reverse takeover of Spinnaker Opportunities. At its current share price, it has a market-cap of about £100m.

Kanabo says it has conducted “extensive R&D” in order to develop high-quality cannabis extract formulas, innovative medical-grade vaporisers, and various non-smoking consumption solutions. It says it’s selling initial products in Europe already, and is ready to scale up to meet market demands and projected sales and revenues.

The company’s leadership team is made up of experienced medical industry professionals in a variety of fields shaping the medical cannabis industry. The CEO, Avihu Tamir, is a cannabis entrepreneur with five years ‘hands-on’ experience in multiple cannabis ventures. He’s also the founder of Teva Nature, the leading vaporiser company in Israel.

I’m bullish on cannabis

I’m relatively bullish on the legal cannabis industry from a long-term investment point of view. Already, over 30 countries worldwide have legalised cannabis for medical use.

Between now and 2026, the global legal cannabis market is projected to grow at a compound annual growth rate (CAGR) of more than 30%. This means there are likely to be plenty of opportunities for investors.

That said, I’m not convinced at this stage that Kanabo stock is a good fit for my portfolio. For starters, I can’t see the company having a clear competitive advantage. There are lots of companies developing CBD products today. Does Kanabo have an edge over the competition? It’s not clear to me.

Secondly, Kanabo is still very much unproven at this stage. As it says in its prospectus: “Kanabo has a short trading history and is unable to demonstrate any significant revenue being generated as at 31 December 2019. Investors therefore have a very limited basis on which to evaluate potential future performance of the Enlarged Group. The Enlarged Group may continue to generate sustained losses in the event that it is unable to generate sufficient revenue from the sale of its Retail CBD Products.”

It also notes in its prospectus that “the group may not commercialise its medical cannabis products.” I like to invest in companies that have proven track records of success.

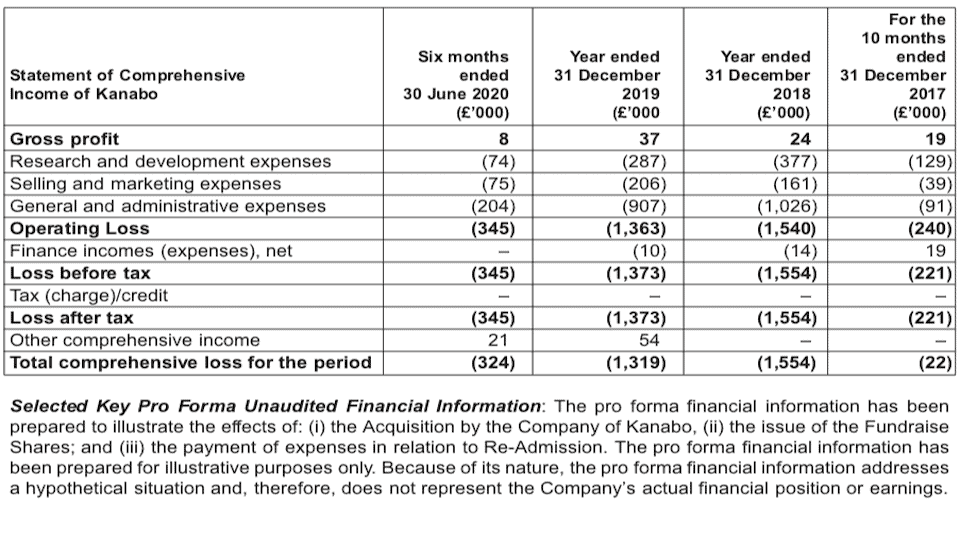

Third, the financials concern me. I prefer to invest in growth companies that are already profitable. I’ve found that investing in these types of companies reduces risk significantly. Kanabo, at this stage, isn’t yet profitable.

Source: Kanabo

Source: Kanabo

KNB also states in its prospectus it had retained losses of approximately £3.1m (as at 31 December 2019) as a result of costs incurred in connection with early stage R&D activities.

Kanabo shares: too speculative for me

Kanabo could be successful. However, looking at the investment case, the stock is too risky for me. I think a safer way to play the cannabis growth story is a thematic ETF (a tracker fund that taps into a specific theme).