Most adults dream of earning more money, whether through hard work, a lottery win, or carefully chosen investments. For many people it never goes beyond the stage of dreaming. But for some, it really comes true. Billionaire investor Warren Buffett, and his widely quoted methodology, has gone a long way to transforming ordinary citizens into ISA millionaires. His tried-and-true strategies make stock market investing simple and accessible to any of us, and that’s what impresses me the most.

Warren Buffett’s influence

It’s not just individuals that have transformed their lives for the better. Many professional stock pickers also incorporate Buffett’s wisdom into their approaches. One such success story is that of Nick Train. Sometimes called Britain’s answer to Warren Buffett, Train is a highly successful fund manager who has also helped many UK inhabitants become rich.

Train runs investment trusts and funds, including LF Lindsell Train UK Equity and Lindsell Train Global Equity. The crux of his strategy is to buy and hold, which is at the heart of Buffett’s mantra too. Train keeps his portfolio small with a few champion stocks he really believes in.

The SDL UK Buffettology Fund is another UK fund inspired by Buffett’s prowess, founded by boutique asset manager Sanford DeLand. Over the past three years the Buffettology fund has delivered a 23% return for investors, although it’s down 0.8% in the past year.

On a path to riches

Buffett’s advice is simple; buy stocks in an undervalued state and hold for as long as possible. The stocks he prefers usually offer a dividend yield, which means they automatically come with an additional interest payment paid back to the shareholder throughout the year. Dividends are usually annual, but sometimes quarterly or bi-annual. The reason this buy-and-hold strategy works is that the interest payments generate interest payments, quickly creating the snowball effect of compound interest.

Choosing which stocks to invest in is the hard part. But by following a few key factors, it needn’t be as difficult as one may think. I have been reading and writing about Buffett’s strategy for some time now and I think I can sum it up as follows: Choose a stock that I really believe in. A company I believe will stand far into the future. One that I wish I owned a piece of and that I really understand the point of. An excellent company has a competitive edge and a strong management team. It will offer a dividend to thank shareholders for their support and it will not be overvalued.

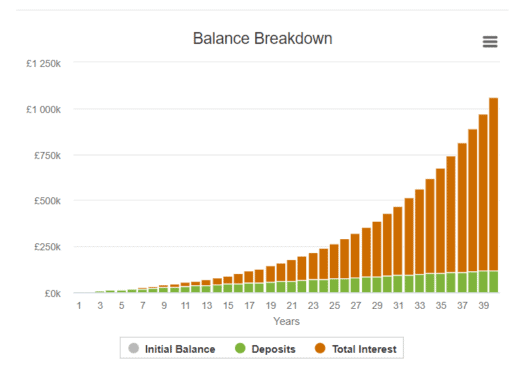

And to show how compound investing works, consider this: If I was to invest £250 a month into a Stocks and Shares ISA generating an effective annual rate of interest at 9%, then after 40 years I would have £1,062,412. In this example, it compounds interest yearly. My final sum will vary depending on the amount I deposit, the annual rate of return, and how long I can afford to leave it.

Source: The Calculator Site

All-in-all, this proves that Buffett’s buy-and-hold strategy has merit and can turn everyday investors into stock market millionaires.