US technology stocks are popular with UK investors right now. Apple and Tesla, for example, have been two of the most bought stocks on Hargreaves Lansdown recently.

Personally, I’ve been buying Microsoft (NASDAQ: MSFT) stock for my ISA. This tech share – which is the top holding in Terry’s Smith’s Fundsmith portfolio – has an enormous amount of appeal from a long-term investment point of view, in my opinion. Here’s why I like the stock.

Why I’m buying Microsoft stock

One reason I like MSFT is that it has dominant positions in a number of growth industries.

In the business world, it’s a key supplier of productivity solutions. Not only does it own Office (which is now cloud/subscription-based) but it also owns the collaboration platform Microsoft Teams. This means it’s well placed to benefit from the work-from-home trend.

Microsoft is also a key player in the cloud computing industry with its Azure business. This is a flexible cloud platform that provides storage, networking, and analytics without the need for costly on-premise server infrastructure. The global cloud computing market is set to grow phenomenally in the years ahead, from around $370bn now to $830bn by 2025. Microsoft is well placed to benefit.

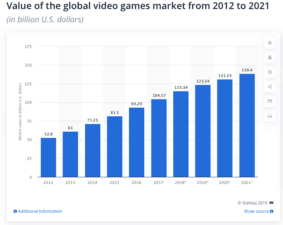

Additionally, Microsoft has a dominant position in the video gaming industry. It owns Xbox and has recently been making a number of major acquisitions in the gaming space. Video gaming is a huge industry that is growing rapidly. Microsoft should benefit.

Source: Statista

Finally, it also owns a major social media platform in LinkedIn. This has become a key job search and networking platform in recent years.

Overall, the dominant positions Microsoft has provide the company with a strong competitive advantage.

Fundsmith’s top holding

I also like the look of Microsoft’s financials. Its top line is growing at a very healthy pace. Over the last three years, revenue has climbed from $97bn to $143bn. That represents a compound annual growth rate of about 14%. Looking ahead, analysts forecast revenue of $157bn this year and $175bn next year.

Microsoft is also very profitable. Over the last three years, return on capital employed (ROCE) has averaged 20.1%. The company sports a fantastic dividend growth track record. Recently, the company lifted its payout by 10%.

Additionally, its balance sheet is very strong. At 30 June, the company had $136.5bn in cash and short-term investments on its books. That will give the company the firepower to make further acquisitions in high-growth industries.

All in all, this is a stock that screams ‘quality’ to me. It’s not hard to see why Fundsmith manager Terry Smith – the man they call ‘Britain’s Warren Buffett’ – likes the stock.

Microsoft: a growth champion

Microsoft’s share price has enjoyed a good run over the last few years. As a result, the stock isn’t a bargain right now. However, I don’t think the current forward-looking P/E ratio is 32 is overly expensive either. For a highly-profitable tech giant with exposure to cloud computing, video gaming, and social media, I don’t think that valuation is unreasonable.

I’ve been building up a position in Microsoft stock for a little over a year now. I plan to keep buying more. In my view, Microsoft has all the right ingredients to be a top core holding.