Amazon (NASDAQ:AMZN) stock has had a wonderful time since the beginning of the pandemic. But many people around the world, including UK investors, are wondering if it is still a buy.

The recent Nasdaq rally is spectacular, indeed. It can only be compared to the dotcom bubble. In the 1990s, Americans dreamed of getting rich from Internet commercialisation. It was the period of IPOs for loss-making high-tech companies. At the same time, the Fed was pouring cheap money into the market. Of course, the bubble eventually burst.

Even though blue chips like Cisco, Intel, and Oracle survived the crisis, their shares plunged by around 80%. One of the notable survivors was Amazon. In the 1990s it was a small business. But now, as we all know, it is one of the largest and most popular companies in the world. It looks as if it’s overpopular right now. But let’s have a look at the fundamentals.

Amazon stock – qualitative factors

To start with, it is the absolute leader in e-commerce. Although it’s a well-diversified business, the bulk of its sales are due to online and physical stores. But it also makes plenty of money through subscriptions and web services. I was surprised to find out that most of its sales growth in Q2 of 2020 was in North America. It might seem logical that developing countries deliver impressive growth as opposed to developed countries like the US. But the international segment has always been the corporation’s weak spot. What’s more, household spending in the US was really well supported by the government. In fact, one of the first relief bills passed by the Congress was ironically called ‘The Amazon Support Act’ by some analysts!

Of course, the demand for online delivery of essentials such as food and household supplies has surged to historically high levels. And the corporation was more than prepared to cope with it. Its Whole Foods Market division was particularly useful in the situation.

But the company’s sales growth has always been impressive, even before the pandemic.

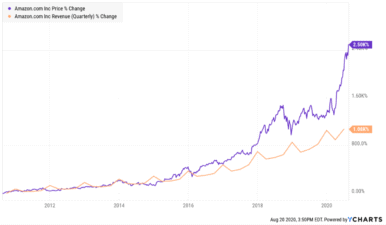

Here’s the 10-year revenue history graph.

Source: YCharts

Over the period the company managed to increase its sales by 1,000%. That’s 100% per year on average! Looks great.

Valuation

At the same time, as can be seen from the graph, the sales growth rate is much more moderate than the Amazon share price rise. Over the same period Amazon stock surged by 2,500%. Most of the boost happened this year but it looks like revenue couldn’t keep up.

The second quarter earnings results were, however, brilliant. Net income rose from $2.6bn in Q2 2019 to $5.2bn in Q2 2020. Almost two times! And how about Amazon’s liquidity? Well, it is quite strong. In fact, on 10 February 2020, Moody’s decided to upgrade Amazon’s credit rating to A2, a strong investment grade. So, it looks like the company is doing very well.

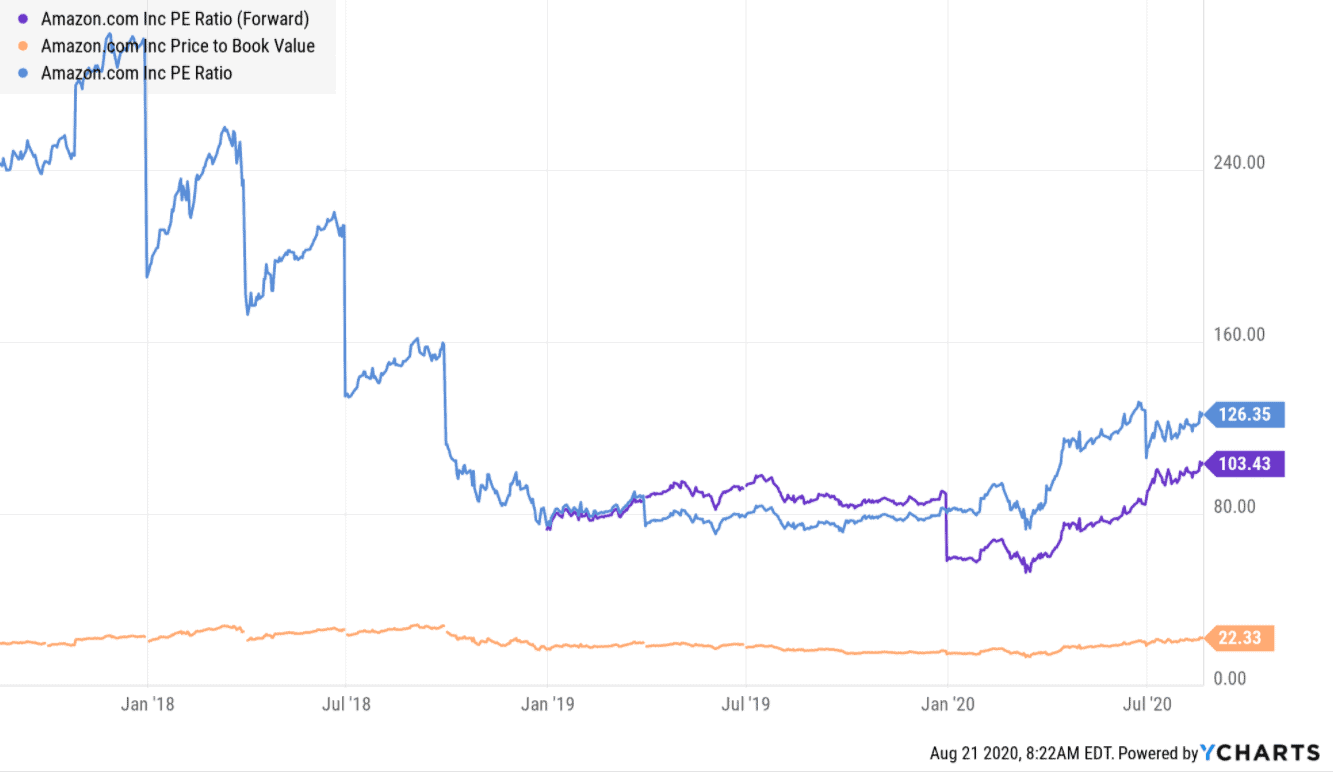

Source: YCharts

At the same time, if we look at the history of Amazon’s accounting multipliers, the stock doesn’t seem to be overly expensive. But the price-to-earnings (P/E) and the forward P/E ratios of 126 and 103 would be extremely high for any other company.

Should UK investors buy Amazon stock?

Overall, I agree with my colleague James, who would prefer the stock to drop before he’d buy it. It’s always a mistake to overpay for something, I think.