Keeping an eye on what fund managers are doing can be a smart move. Not only can it help you identify investment opportunities, but it can also help you avoid risks.

With that in mind, I want to highlight 10 UK shares that fund managers piled into in the first half of 2020. The data comes from fund specialist Trustnet, who looked for the stocks in UK All Companies funds’ top 10 holdings that saw the greatest change in ownership between 31 December 2019 and 30 June.

Fund managers bought these UK shares in 2020

The UK share that saw the greatest change in ownership was consumer goods company Reckitt Benckiser. At the end of last year, only 4.43% of funds in the UK All Companies sector held the stock in their top 10 holdings. However, by 30 June, that rose to 15.82%.

It’s not hard to see why fund managers like Reckitt Benckiser at the moment. As the owner of a wide range of health and hygiene brands, including Dettol and Lysol, it’s well-placed for growth in the current environment.

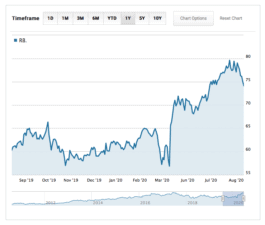

In second place was mining giant Rio Tinto. Its ownership jumped from 20.57% to 26.58%. I’m actually quite surprised to see RIO in second place as mining stocks tend to be quite cyclical. That said, iron ore prices have remained robust this year and, unlike many other FTSE 100 companies, RIO hasn’t cut its dividend in 2020.

In third place was another consumer goods company, Unilever. Its ownership climbed from 17.41% to 23.41%. This one doesn’t surprise me at all. Unilever is a very reliable company. When economic uncertainty increases, investors tend to gravitate towards the stock.

Behind Unilever was pharmaceutical giant AstraZeneca. Its ownership increased from 25% to 29.12%. This seems like an obvious pick in the current environment. Not only is AZN a defensive stock but it’s also leading the fight against Covid-19.

In fifth place was British American Tobacco. Its ownership during the period rose from 19.94% to 23.42%. I imagine it’s the combination of the stock’s defensive attributes and its attractive dividend yield that has driven demand for this UK share.

Next up was data and analytics specialist Relx. Its ownership jumped from 13.92% to 17.09%. This one also surprises me a bit as one of the company’s business segments is exhibitions. That said, in today’s digital world, Relx looks well-placed for growth due to its analytics expertise. So, perhaps fund managers are looking at the recent share price dip as an opportunity.

Behind Relx was healthcare company GlaxoSmithKline. Its ownership increased from 31.33% to 34.18%. Like AstraZeneca, this stock seems like an obvious choice in the current environment.

The final three stocks in the top 10 most-bought UK shares were insurance firm Lancashire Holdings (0.00% to 2.53%), public services provider Serco Group (0.00% to 2.22%), and energy company SSE (0.63% to 2.85%).

Would I buy these stocks?

Would I buy any of these UK shares today? Certainly some of them. From this list of shares, the three stocks I’d go for today would be Reckitt Benckiser, Unilever, and GlaxoSmithKline. I think all three have solid prospects in the current environment.