The last time I covered Shell (LSE: RDSB) shares was on 10 March. At the time, Shell’s share price had just crashed spectacularly due to plunging oil prices and the oil price war that had erupted between Saudi Arabia and Russia. My view back then was that Shell’s share price weakness was a buying opportunity.

Fast forward to today, and Shell’s share price is actually lower than it was when I covered the stock in March. Did I get it wrong? Let’s take another look at the investment case for Shell.

Shell shares: can they recover?

Since my last article, the outlook for Shell has improved to a degree. Many countries are slowly coming out of lockdown and, as a result, demand for oil is picking up. China, for example, imported approximately 13m barrels per day (mb/d) in June, a record high.

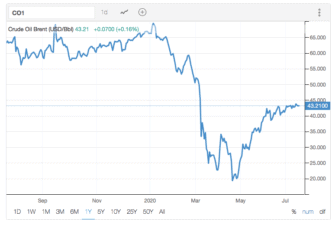

As you can see in the chart below, the price of Brent crude oil has rebounded significantly since April.

Source: Trading Economics

This rebound in the oil price is good news for Shell, as higher prices translate to higher cash flows and profits for oil companies.

Shell share price: an uncertain future

However, in terms of a recovery in Shell’s share price, there are a few other issues to consider. The first is Shell’s dividend. In the past, Shell was seen as a very dependable income stock that both private and institutional investors relied on for consistent dividends.

The situation is now very different. In its first-quarter results, Shell did the unthinkable and cut its dividend (for the first time since World War II). It was a significant cut too, with the payout reduced by 66%.

That kind of cut is likely to impact sentiment. No longer is Shell a rock-solid income stock.

Additionally, that cut says something about the challenges Shell’s facing. Analysts at Credit Suisse recently said the dividend cut is reflective of times to come, with “a harsh operating environment in the near term and slower recovery over the medium term.”

Another issue that could hold Shell’s share price back is uncertainty in relation to future oil demand. In the short term, people are less likely to travel internationally due to Covid-19. Meanwhile, the work-from-home trend means people may travel less on a permanent basis. This potentially translates to lower demand for oil. This could hurt Shell’s share price going forward.

Finally, it’s also worth thinking about today’s focus on sustainable investing. Increasingly, institutional investors are investing on a sustainable basis as that’s what their clients are looking for. Shell cannot be considered a sustainable stock. This means it may not generate the same kind of investor interest that it has in the past.

Are RDSB shares worth buying?

Shell’s share price could still rebound. However, a sustained recovery is far from guaranteed, given the many challenges the FTSE 100 company faces today.

I own Shell shares and will hold on to them, for now. However, I think there are much better stocks than Shell to buy today.

Instead of investing in an industry that’s set to experience challenges in the near term, I’d be looking at buying high-quality stocks in industries that are set for growth in the years ahead.