2020 has been a challenging year for UK income investors, so far. Due to coronavirus carnage, over 40 companies in the FTSE 100 have cancelled or suspended their dividends.

Income-focused investment trusts could offer investors some protection from the widespread dividend cuts. One big advantage of income investment trusts is they provide exposure to a wide range of dividend-paying companies, limiting stock-specific risk.

In addition, investment trusts can retain up to 15% of the income they collect every year and use these ‘reserves’ to top up payments to investors during lean income years. This is a very handy feature if your objective is to generate regular income.

Below, I highlight two high-quality income-focused investment trusts I hold in high regard.

Investment trusts for income

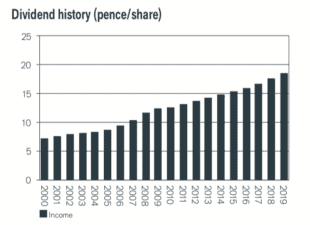

The first I want to highlight is the City of London (LSE: CTY). This is a conservatively-managed investment trust that has a strong focus on large, blue-chip FTSE 100 companies. It has a phenomenal dividend track record, having increased its payout to investors every year for over 50 years now.

Source: City of London Investment Trust

There are a few reasons I like the look of CTY right now. Firstly, its top holdings are reliable dividend payers. At 31 May, its top four holdings were British American Tobacco, Diageo, GlaxoSmithKline, and Unilever. None of these companies have cut their dividends in 2020.

Secondly, at 31 December 2019, the trust had £55m in reserves. This means it should have the firepower to continue paying dividends to investors in the current environment.

Last year, City of London trust paid out 18.6p per share in dividends, which equates to a trailing yield of 5.8% at the current share price. There’s no guarantee it’ll pay out the same level of dividends this year, however, I think the total payout will be attractive in the current environment.

If you’re looking for a reliable investment trust for income, I think CTY has a lot of appeal.

Dividend hero

Another investment trust I like for income is the Murray Income Trust (LSE: MUT). This one has a 5-star rating from Morningstar. It also has AIC ‘dividend hero’ status (as does CTY), meaning it has increased its dividend every year for over 20 years.

Like City of London, Murray Income Trust is invested in some very reliable dividend payers. At 31 May, its top four holdings were AstraZeneca, GlaxoSmithKline, RELX, and Diageo. None of these companies have reduced or cancelled their payouts in 2020.

And just like CTY, it has a solid level of reserves. According to a recent research report from Edison, MUT has sufficient revenue reserves to maintain its quarterly dividend payments for several quarters, if need be. The trust also expects to be able to maintain its long-term record of increased annual dividends, according to Edison.

Murray Income Trust has delivered a strong overall performance recently. For the year to 31 May, its NAV fell just 3.3%. By contrast, its benchmark, the FTSE All-Share index, fell 11.2%.

Meanwhile, the trust paid out dividends of 34p per share for 2019, which equates to a trailing yield of 4.5% at the current share price. Again, there’s no guarantee investors will see that level of payout this year. I’m confident the payout will be attractive though.