The FTSE 100 index has had a good run since late March, rising over 25%. But there are still plenty of cheap stocks within the index. Here’s a look at two attractively-valued FTSE 100 stocks I like the look of right now.

A FTSE 100 bargain

One FTSE 100 stock I’m very bullish on at present is financial services company Prudential (LSE: PRU). There are a number of reasons I see investment appeal here.

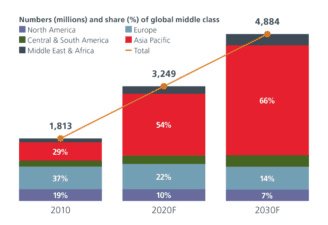

Firstly, after spinning off its UK-focused asset management arm last year (now known as M&G), Prudential is now predominantly focused on providing financial solutions to customers in Asia. I see huge potential here, as wealth across Asia is set to rise significantly in the years ahead. “The fast-growing markets of Asia offer long-term structural opportunities for us,” said CEO Mike Wells recently.

Source: Prudential

Secondly, there’s been some encouraging insider buying here recently. Last week, non-executive director Shriti Vadera purchased 67,500 Prudential shares, spending over £800,000 on stock. Vadera – who is currently chair of Santander UK Group Holdings – is expected to succeed Paul Manduca as chair of the board at Prudential on 1 January 2021. This purchase suggests the insider is confident about the future.

Prudential shares currently trade on a forward-looking P/E ratio of about 7.7, using next year’s earnings forecast. At that valuation, I believe the shares are an absolute steal. Analysts at Morgan Stanley have a target price of 1,626p for the FTSE 100 stock – roughly 37% higher than the current share price.

Huge growth potential

Healthcare is a sector I really like right now. The reason I’m bullish on this sector is that it looks set for big growth in the years ahead due to the world’s ageing population. As we age, our demand for healthcare tends to increase.

One of my preferred plays in the UK healthcare sector is FTSE 100 constituent Smith & Nephew (LSE: SN). It’s a leading medical technology company that specialises in joint replacement systems, advanced wound management solutions, and surgical robotics. It has a fantastic track record when it comes to generating shareholder wealth and has paid dividends on its ordinary shares every year since 1937.

In the short term, I expect Smith & Nephew to experience some challenges related to Covid-19. That’s because a lot of elective surgeries have had to be postponed this year due to lockdowns. As a result of the coronavirus, first-quarter sales fell 7.6%.

However, in the long-run, I think the growth potential here looks formidable. With the number of people across the world aged 60 or older set to rise to 1.4bn by 2030, up from 901m five years ago, I can see demand for Smith & Nephew’s products increasing significantly.

Smith & Nephew shares currently trade on a forward-looking P/E of 18 using next year’s earnings forecast. For a FTSE 100 company with an outstanding track record and compelling growth potential, I think that’s cheap.

I’d buy the shares now while they’re around 25% below their 52-week highs.