The Glencore (LSE:GLEN) share price dropped dramatically because of the Covid-19 pandemic. But could the mining company’s stock fully recover and make its holders rich?

Glencore share price

Glencore specialises in the mining of cobalt, nickel, copper, zinc, lead, aluminium, gold, and silver. It also extracts oil and gas. As we all know, due to the coronavirus outbreak, lockdowns, and resulting recession, there has been quite low demand for natural resources.

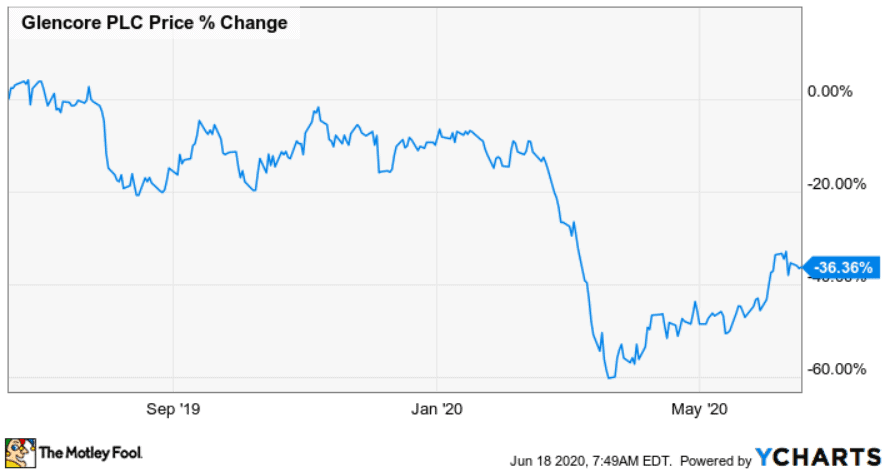

So, the commodities producers have been on sale for a while. Even though Glencore’s stock has recently seen some upsurge, it is still more than a third below the January levels.

The company’s news

Tesla, an overhyped American car maker, is increasing its electric vehicle (EV) production. To do so, Tesla needs to buy cobalt, a material essential for making batteries. It signed a contract with Glencore to supply this material. But the good news for the mining company does not end here.

Growing consumer interest in environmental issues has prompted many other car producers, including BMW, start producing electric vehicles. In order to do so, they also need cobalt. But this material isn’t just used for producing EVs, it is also needed by companies producing laptops and smartphones. So, Glencore is in an excellent position, since it is the leader in mining this material.

However, investors should be aware of the reputational risks linked to Glencore’s cobalt production. The problem is that most cobalt comes from Congo, where child labour is used. In December 2019, the mining company even had to issue a news release saying that it did not use any forms of child labour.

Is Glencore worth investors’ attention?

The 2019 results were not amazing for Glencore. The mining company reported its first annual net loss in five years. Remember that there was no coronavirus lockdown in 2019. As my colleague Alan Oscroft very correctly pointed out in his February article, a couple of tough years might be ahead for Glencore. It really looks so, since the Covid-19 pandemic appears to particularly harmful to natural resources companies.

In terms of dividends, it seems that the company won’t be able to announce or pay any new dividends this year and will instead try to conserve cash. So, its attractive dividend yield of over 11% it not sustainable after all.

Glencore still has an investment-grade credit rating. Moody’s rates the mining company as Baa1, or lower investment grade. However, the agency noted that the company borrowed heavily in 2019 when commodity prices were quite low. At the same time, Glencore paid its shareholders substantial dividends, thus decreasing its free cash flow. Covid-19 has made the situation much worse. But Moody’s still thinks that Glencore will be cash positive in 2020 because probably not paying dividends. Since the pandemic crashed many developing countries’ currencies, some of Glencore’s costs went down too. This is because the mining company operates in these countries and has to export the commodities elsewhere.

Although Glencore could be worth buying for patient investors, I think that there are still better alternatives in the mining industry and other sectors.