The FTSE 100 index recently had its worst quarter since 1987. As a result, many high-quality companies’ share prices are now far lower than they were at the start of the year.

For long-term investors, the lower FTSE 100 share prices on offer right now could be a real opportunity. Stock market volatility is likely to remain elevated in the near term. However, eventually, share prices should rebound.

With that in mind, here’s a look at a stock I believe is worth buying today for the long term.

FTSE 100 opportunity

Financial services company Prudential (LSE: PRU) has seen its share price hammered this year. Back in early January, the FTSE 100 stock was trading at 1,450p. Today, however, you can buy it for around 1,000p.

Of course, there’s now far more short-term economic uncertainty than there was at the beginning of the year. So it makes sense Prudential’s share price is lower. However, in my view, investors would be wise to look beyond the near-term coronavirus-related uncertainty. Instead, you should focus on the long-term story here, as the company’s growth potential is immense.

Huge long-term growth potential

You see, Prudential recently demerged its lower-growth European asset management arm (now M&G). It’s also due to split off its American retirement solutions arm, Jackson.

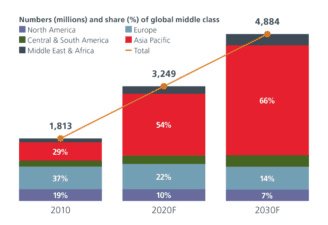

This means that, going forward, the FTSE 100 company is set to be focused entirely on the financial needs of those in Asia. Given that wealth is expected to rise rapidly across many Asian countries (meaning higher demand for savings and insurance products) in the next decade, the long-term growth potential is substantial, in my view.

This is summed up well by Prudential CEO Mike Wells, who said recently: “The fast-growing markets of Asia offer long-term structural opportunities for us, with the region’s growing population having a clear and increasing need for the products we deliver.”

The growing middle class in Asia

Source: Prudential

Coronavirus impact

I’ll point out that in the short term, Prudential’s profits are likely to take a hit from the coronavirus. Last month, the company advised that the pandemic had dampened its sales momentum in Hong Kong and China and that lower levels of new sales activity would impact new business profit.

However, the FTSE 100 company also said its robust business model was lending “considerable resilience” to its earnings and that the business was positioned for further growth in the future.

“I am confident that, with our clear focus on our structural growth markets and our continuing operational improvements, we will continue to deliver profitable growth for our investors and benefits for our stakeholders over the medium and long term,” said Wells.

FTSE 100 bargain

It’s worth noting that there are risks to the investment case. If the coronavirus situation deteriorates further, insurers could find themselves under more financial pressure.

Another risk is that regulators may force insurers to suspend their dividends in the near term. There’s also a chance the share price could fall further if the FTSE 100 index tanks again.

Overall, however, I think the risk/reward proposition is attractive right now, considering the long-term growth story.