Deciding where to invest during a stock market crash can be a hard job. In order to do so, you have to understand whether you are a defensive or an enterprising investor.

An enterprising or an aggressive investor would buy the most undervalued companies in the most affected sectors. A defensive investor, on the other hand, would aim to buy easy-to-understand, non-cyclical businesses at a discount.

In this article I focus on the best solutions for an aggressive investor.

Reacting to this market crash

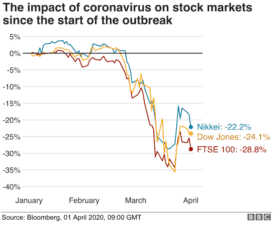

It is painul to see the FTSE 100 index plunging so rapidly. Yet, it is important to avoid panicking. Remember that “this too shall pass“. However, it is quite hard to say exactly when the market reaches its bottom. So, sound companies should be acquired at reasonable prices.

Market crash

Market crash

Best buys for enterprising investors

The coronavirus collapse has, sadly, affected many people and their health. It has become a national emergency in many countries all over the world, and has influenced the world’s economy.

In terms of industry, the most affected are oil and natural resources companies, airlines, tourism companies, and financials. It seems to me that only the fittest will survive in such a situation. This means large profitable companies with the most sound fundamentals.

Oil companies

If you are thinking of betting on oil price recovery amid this record market crash, I would go for Royal Dutch Shell rather than British Petroleum. This is because RDS is a larger company. That is, it has higher sales revenues and net assets. Moreover, Royal Dutch Shell’s price-to-earnings (P/E) ratio of 7.83 is much lower than BP’s 17.81.

BP is trading at a brice-to-book (P/B) of only 0.71, whereas RDS is trading at just one-third of its book value. Both companies’ dividend yields of over 9% are not sustainable in the short run, due to low oil prices. Yet, RDS’s dividend cover of 1.05 is better than BP’s 0.62.

Airlines

I had a look at the top airlines in the FTSE 100. It is widely discussed in the news that the government would bail out the largest airlines should the situation get worse. International Consolidated Airlines Group and EasyJet do not have perfect accounting fundamentals. International Consolidated Airlines’ P/E ratio of 2.32 comes at a handsome dividend yield of 7.26%, whereas EasyJet’s P/E ratio comes at 5.61. EasyJet’s dividend yield, however, is 8.83. Both companies have a low current ratio below 1. This means that they would be unable to meet their short-term liabilities. From the two, I would choose International Consolidated Airlines, again because of its size.

Market crash for financials

The financial sector has also been hit quite hard by the general panic. The top banks have even cancelled their dividend payouts and share buybacks. However, it seems to be a temporary measure. Analysts predict that major banks will start paying their dividends again at the end of 2020.

The top banks in the FTSE 100 in terms of capitalisation are HSBC and Barclays. Even though HSBC is by far the larger of the two, Barclays is trading at more attractive multiples. HSBC’s P/E ratio is 13.26, whereas Barclays’ P/E is only 5.71.