Instead of buy-to-let property, I would suggest buying the FTSE 100 index or undervalued FTSE 100 shares.

BT Group (LSE: BT-A) looks like a great investment opportunity to me. This may sound crazy, given that the crashing stock market might make this option look unattractive for investors.

Buy-to-let

To start with, buy-to-let investing might look risk-free. After all, a block of flats or a house is literally set in stone. A company, on the other hand, might go bankrupt. Its shareholders would, in that case, be left with only the book value, which is not always positive. Investing in shares might look especially risky now that the stock market keeps falling.

Moreover, if you buy a studio in a large city at a reasonable price it would not be a problem to let it. Tenants normally pay rent on time. Provided you buy it at a discount, you would be left with a sound investment and a good regular income.

However, property is illiquid or not easily turned into cash. It might take many months if not years to sell a flat or a house at a favourable price. It takes a lot of time and effort to find suitable tenants willing to rent at a particular price.

Moreover, it might be necessary to repair and refurbish the property, which is both costly and time-consuming.

Finally, the profit and income might not be as high as in the case of investing in the stock market.

FTSE 100 shares

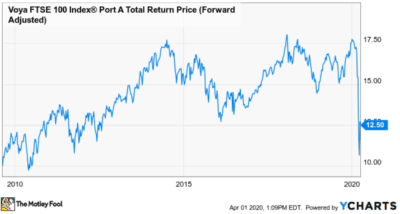

For investors seeking diversification, buying a low-cost index fund that reflects the FTSE 100 might be a very reasonable decision. My colleague Rupert Hargreaves has written about the benefits of tracking the FTSE 100. I’d note that it’s an investment that can also pay dividends.

Consider this example of an index fund that investors can now buy at a substantial discount.

One of the Footsie’s stocks

The company’s website reads “The services we sell are integral to modern life“. Indeed, they are. BT Group is a mobile network operator, one of the largest pay-TV sports broadcasters in the UK, and an internet provider. Moreover, it provides cloud services to multinational companies.

In a situation when most people are isolated at home, such companies are some of the few to benefit. Many employees are forced to work from home, and are likely using cloud technologies. Many families are entertaining themselves by watching TV or online content.

From a fundamental perspective, the company is trading at a price-to-earnings ratio of 5.27, which is extremely low. The dividend yield is 13.41%, whereas the dividend cover ratio is 1.42. I’d prefer to have a higher dividend cover ratio. However, I believe BT’s dividend is sustainable. It is likely to see a boost in profitability as a result of the current environment.