In the current low-interest-rate environment, dividend stocks are getting a lot of attention. That’s not really surprising when you consider that many dividend-paying stocks offer yields of 5% or more – much higher than the interest rates on savings account. Royal Dutch Shell shares, for example, offer a yield of around 6.2%, which is attractive when savings accounts are only paying 1% or so. Are dividend stocks a good investment though? Let’s take a look at some research.

Dividend stock research

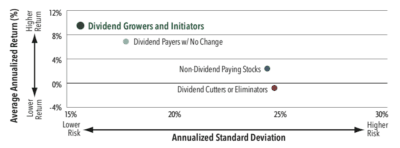

Now, I’d love to be able to show you some research in relation to the long-term performance of UK dividend stocks, but research studies involving UK dividend payers are few and far between. So let’s look at research into US dividend stocks. One of the best studies in this regard is by independent firm Ned Davis Research. In this study, analysts examined the performance of dividend stocks in the S&P 500 index between 31 January 1972 and 31 December 2018.

Strong returns

What the analysts found is that, over this period, dividend stocks as a whole delivered total returns (dividends and capital appreciation) of 8.78% per year. That’s certainly a healthy return. By contrast, the equally-weighted S&P 500 index generated an annualised return of 7.3%, while non-dividend-paying stocks delivered annualised returns of 2.4%. This suggests that dividend stocks are indeed good long-term investments and could potentially be better ones than non-dividend-paying stocks.

Dividend growers = the best returns

What’s really interesting is that a specific subset of dividend stocks delivered even higher returns. Indeed, the study found that the dividend stocks that performed the best over this period were those that had grown their dividends or started dividends. These companies delivered annualised returns of 9.62%. Moreover, they generated higher returns with a lower standard deviation (a key measure of risk). By comparison, dividend cutters and eliminators underperformed quite substantially, with annualised returns of -0.79% and a higher level of risk.

Source: Santa Barbara Asset Management and Ned Davis Research

What this suggests is that if your goal is high total returns, and not simply a high yield today (i.e. you’re investing for the long term), the best strategy when investing in dividend stocks is to focus on companies that are consistently increasing their payouts.

Focus on dividend growth

This theory is well supported by looking at the performance of the S&P 500 Dividend Aristocrats (S&P 500 companies that have increased their dividend payouts for at least 25 consecutive years) over the last decade.

According to the latest factsheet, for the 10-year period ending 31 December 2019, the Dividend Aristocrats generated total returns of 14.75% per year versus 13.56% for the S&P 500 index. Impressively, they generated this outperformance with a lower standard deviation than the index.

In conclusion, research suggests that dividend stocks are good long-term investments. However, if your goal is to generate high total returns, it could be a smart idea to focus on companies that consistently increase their dividend payouts as these companies tend to generate the strongest risk-adjusted returns over time. There are plenty of those in the FTSE 100 here in the UK.