Calculating how much money you need for retirement is not straightforward. And neither is calculating how much money you should have saved up for retirement by certain ages.

This is because there are many variables that need to be considered. For example, first there are basic retirement variables that you can control, such as the age you plan to retire, and the kind of lifestyle you plan to live in retirement. But then there’s a whole stack of variables that you can’t control, such as your life expectancy, the returns your investments are likely to generate over time, and inflation rates. So, overall, working out how much money you should have saved for retirement by ages 40, 50 or 60 is rather complicated.

Savings model

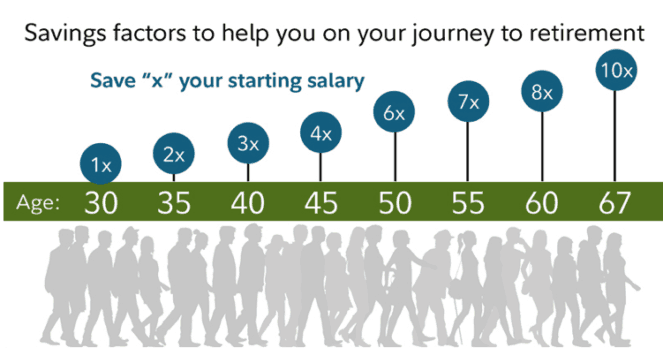

That said, analysts at US investment manager Fidelity have recently put together a basic retirement savings model that provides some insight into how much money people should have saved for retirement by certain ages.

The model – which aims to help people plan for retirement effectively – is based on certain key assumptions, such as a retirement age of 67 and a retirement lifestyle that is similar to the individual’s pre-retirement lifestyle. It also assumes that individuals are willing to invest at least 50% of their savings in the stock market over the long run. Here are some key numbers that Fidelity came up with.

How much to save by 40, 50, 60

According to Fidelity, individuals should aim to have three times their salary saved by 40, six times their salary saved by 50, and eight times their salary saved by 60. The final goal should be to have around 10 times your salary saved by 67 when you retire, as shown in the chart below.

Source: Fidelity.com

For instance, if you are 40, earning £40,000, and plan to retire at 67, Fidelity believes you should have around £120,000 saved for retirement. Similarly, if you are 60, earning £50,000, and plan to retire at 67, the investment manager believes you should have around £400,000 saved.

Falling behind

Of course, these numbers are just a guide as to how much money people should have saved for retirement by certain ages. Fidelity advises that if you’re behind in your retirement savings plan, don’t panic, as there are ways to catch up. The key, as always, is to take action.

Action plan

Two things that you can do to boost your savings to where they should be, include saving more regularly and then investing your savings into a diversified investment mix of shares, bonds and cash savings to ensure that they are working for you and generating a healthy return that is in excess of inflation over time. Retirement planning doesn’t need to be complicated, but it is something that people should spend a few minutes on every now and then. If you can get your savings working for you now, you’ll give yourself a good chance of living your dream retirement further down the track.