How handy would a £500 weekly second income be for you? It’d make my life a lot more comfortable, which is why I invest any spare cash I have in the stock market.

Why wouldn’t I? The UK is famous for its strong dividend culture, backed by its huge selection of mature, market-leading, and financially robust companies. AJ Bell expects FTSE 100 companies alone to pay a stunning £80.7bn worth of dividends for 2025.

But how much would one need to invest in UK shares for a £500 passive income each week? Let’s take a look.

Targeting a second income

It’s critical to remember that dividends are never, ever guaranteed. Taking this on board, investors can take action to boost their chances of a strong and sustained second income over time.

One of the most powerful tools for maximising dividends is to build a diversified portfolio of stocks. We’re talking companies spread across sectors and regions, which protects investors’ returns from individual shocks and provides a smooth (and hopefully growing) dividend stream.

But how large would someone’s portfolio need to to generate hundreds of pounds of income a week? That depends on the size of the dividend yield, which shows how much income in dividends someone makes from their investment.

Let’s say an investor is targeting a £500 income with 6%-yielding dividend stocks. At this level, they’d need a portfolio worth just over £433,000.

Is this achievable?

Most people don’t have that sort of sum sitting at the back of a drawer. But given time, it’s a sum which — as history shows — is a very achievable target.

The wealth-building power of the stock market is considerable. The long-term return from global share investing sits at between 8% and 10%. Add in the power of compounding — where investment earnings snowball over time — we have a powerful combination that can multiply one’s returns over the long term.

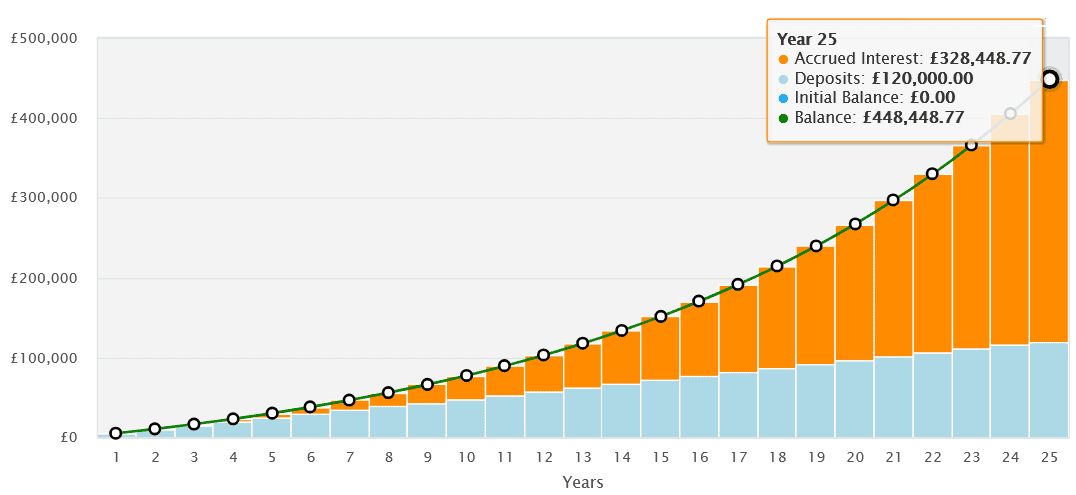

For that £433,000 portfolio, someone could invest £400 a month for less than 25 years and have a realistic chance of achieving that. This is assuming they achieve an average yearly return of 9%.

A FTSE 100 dividend star

Legal & General (LSE:LGEN) is just one great dividend share for investors to consider today. It’s a cash machine, simply put. And it’s shown a strong appetite for returning the excess capital it generates to shareholders.

Excluding pandemic-hit 2020, dividends here have risen every year since 2011. City analysts expect this proud record to continue, resulting in enormous 8.4% and 8.6% dividend yields for 2026 and 2027 respectively.

But can Legal & General keep paying those enormous dividends on its shares? Past performance isn’t always a reliable guide to future returns. And payouts from this point could be impacted if tough economic conditions and competitive threats hit profits.

It’s possible, but on balance I’m confident it’ll remain a top income stock. A Solvency II capital ratio of 217% provides an excellent buffer against any earnings volatility. This is more than double what regulators require.

And looking over the longer term, I expect profits to steadily rise as the financial services market balloons. Given Legal & General’s strong commitment to dividends, this would likely deliver more tasty income for investors