Tracking the most-bought shares and exchange-traded funds (ETFs) on platforms like AJ Bell can be a useful starting point. It can highlight emerging trends and sometimes lead to interesting new ideas to explore further.

With that in mind, let’s take a look at the five most popular ETFs among customers on AJ Bell over the past month.

One major theme

Perhaps unsurprisingly, the dominant theme has been precious metals, with the top two both linked to silver and gold. These were the iShares Physical Gold ETC and iShares Physical Silver ETC, respectively.

Eagle-eyed readers will have spotted that they’re actually exchange-traded commodities (ETCs). Unlike ETFs, these are secured debt instruments backed by the actual metal held in a vault.

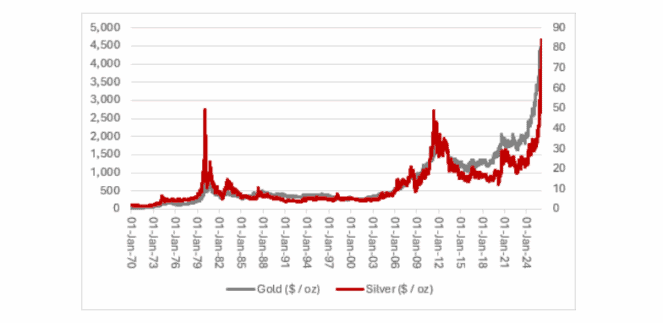

They offer a quick, low-cost way to invest in gold and silver, both of which have been on fire. Gold is now above $5,000 per ounce after jumping 85% over the past year.

Meanwhile, silver has gone truly bananas, skyrocketing 262% to $110 per ounce in the same period.

Russ Mould, AJ Bell’s Investment Director, says: “The dollar’s losses and perhaps fears of more in the face of further perceived presidential caprice, may be persuading investors and central banks alike to seek other stores of value, or havens, in the form of gold and silver. Both are enjoying their third bull market since Nixon withdrew America from the gold standard in August 1971.”

Stock indexes

The other three were the iShares Core FTSE 100 ETF and two Vanguard ETFs that track the S&P 500. Both indexes remain popular despite being just under all-time highs.

Do any of these five interest me? Well, I’m bullish on gold while President Trump’s in power. Tariffs, inflation, ballooning government debt, geopolitical uncertainty, and uncertainty about the US Federal Reserve’s independence make me think the bull market still has legs.

However, I’m not personally interested in chasing gold and silver higher at this point. I think most of the big returns have probably already been made.

And as we see in the chart above, the previous precious metal bull markets were followed by massive multi-year drawdowns.

Meanwhile, the S&P 500 hasn’t been this expensive since the early 2000s. Moreover, the index is incredibly concentrated, with the 10 largest companies accounting for nearly 41% of the total weight at the end of 2025.

A fallen star in the FTSE 100

As for the FTSE 100, I prefer to selectively invest in individual Footsie shares than the entire index. One member that looks cheap to me today is Rightmove (LSE:RMV).

Shares of the dominant property search platform have crashed 39% since August!

The concern here is twofold. First, Rightmove is planning to spend more on AI to future-proof its platform, which will result in lower-than-expected margins this year. Second, some investors fear more people could search for properties via chatbots.

This second one is a theoretical risk. However, it’s worth noting that Rightmove’s trusted brand and data advantages have seen it survive previous competitive threats from Google and Facebook Marketplace.

Rolling out cutting-edge AI tools should further entrench Rightmove’s powerful network effect, in my opinion. And with the stock trading at just 16 times forward earnings, I think Rightmove is worth considering ahead of these five ETFs.