Millions of Britons already use Stocks and Shares ISAs to invest for the long term. In the 2023/24 tax year — the most recent year for which full official data is available — around 4.1m Stocks and Shares ISAs were subscribed to, alongside an estimated 10m total accounts held across the UK.

Over the past decade, stocks and shares ISAs have delivered average annual returns close to 10%, significantly outperforming cash alternatives over that period.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Building your own second income portfolio

A £5,000 monthly second income equates to £60,000 a year. That’s a significant figure and, remember, every penny of it would be free from tax due to the ISA’s tax benefits.

However, we’ve got to be realistic. Generating that much sustainable income requires a large portfolio and strong dividend yields.

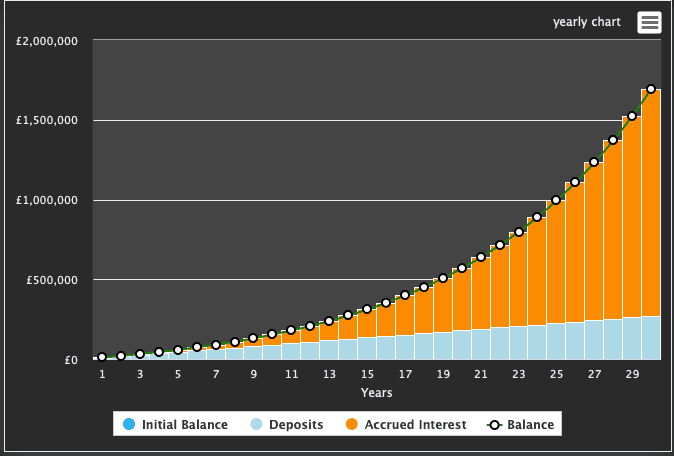

Using a conservative 4% withdrawal rate, common in financial planning to preserve capital through market cycles, an investor would need around £1.5m invested. That assumes drawing income while maintaining the real value of the portfolio over time.

At higher assumed returns — for example, 6% per year — the required capital falls to around £1m. However, higher expected returns come with greater short-term volatility, and income will vary year by year.

It’s also worth noting that it’s easier to pick up these larger returns at different points in the market cycle. A few years ago I was picking up growth-oriented investments with dividend yields above 5%. Today that is harder to find.

Building a £1m portfolio might seem impossible. For example, £750 of monthly contributions for 30 years at a 10% rate of return would give the investor £1.7m.

That’s great in theory, but an investor has to know where to invest. Make the wrong investments, and you could lose money.

Where to invest?

Me and my Foolish colleagues strongly believe that a portfolio of well-researched stocks typically outperforms funds or index-tracking investments.

One stock I believe is worth considering strongly is Georgian bank TBC Bank (LSE:TBCG). It’s a really interesting prospect because its trading at 4.9 times forward earnings, but its growth forecast is super strong.

It’s actually the eighteenth-fastest growing company on the FTSE All Share Index, with analysts projecting 17% revenue growth and 11% earnings growth on average across the next two reporting years.

One reason for this is something of a pullback in 2025 after its shift from micro-loans to the SME business.

“The year has […] clearly had its challenges, with the previously flagged headwinds in 1H, while in 2H, we have pivoted our business from microloans to SME lending more quickly than previously anticipated in line with the changing regulatory agenda”, chief executive Vakhtang Butskhrikidze said in November.

However, that shouldn’t detract from the long-term thesis. It’s operating in two of the fastest growing economies in eurasia, with strong net interest margins and interesting opportunities, including from the takeover of OLX’s marketplace business in Uzbekistan.

It’s also worth noting that all four institutional analysts covering the stock have a Strong Buy rating. The average share price target is 41% above today’s price. It also offers a 6% dividend yield.