Generating a second income of £3,333 a month from a Stocks and Shares ISA is no easy feat. This figure actually equates to just under £40,000 a year in passive income.

And if it’s done in an ISA, all of the income will be free of tax. You’d need to earn approximately £55,000 per year from a salaried job to take home this much after tax.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

This is the real beauty of the ISA. It allows returns to compound undisturbed by the taxman, accelerating long-term wealth creation and making high levels of passive income far more achievable.

Over time, the difference between tax-free and taxed returns can run into tens or even hundreds of thousands of pounds, especially for higher-rate taxpayers.

So, how much would an investor need in an ISA to earn this £40,000 per year?

Using a relatively cautious 4% income rate, an ISA would need to be worth around £1m.

At 5%, the required portfolio falls to roughly £800,000, while a 6% yield would bring it down to about £667,000.

However, it’s important to remember that higher yields are often less sustainable. A few years ago when the market was depressed, it was much easier to lock in big yields.

Today, some of those dividend stocks are trading much higher and the dividend yields (which are linked to to share prices, moving in the opposite direction) have fallen.

Building the portfolio takes time

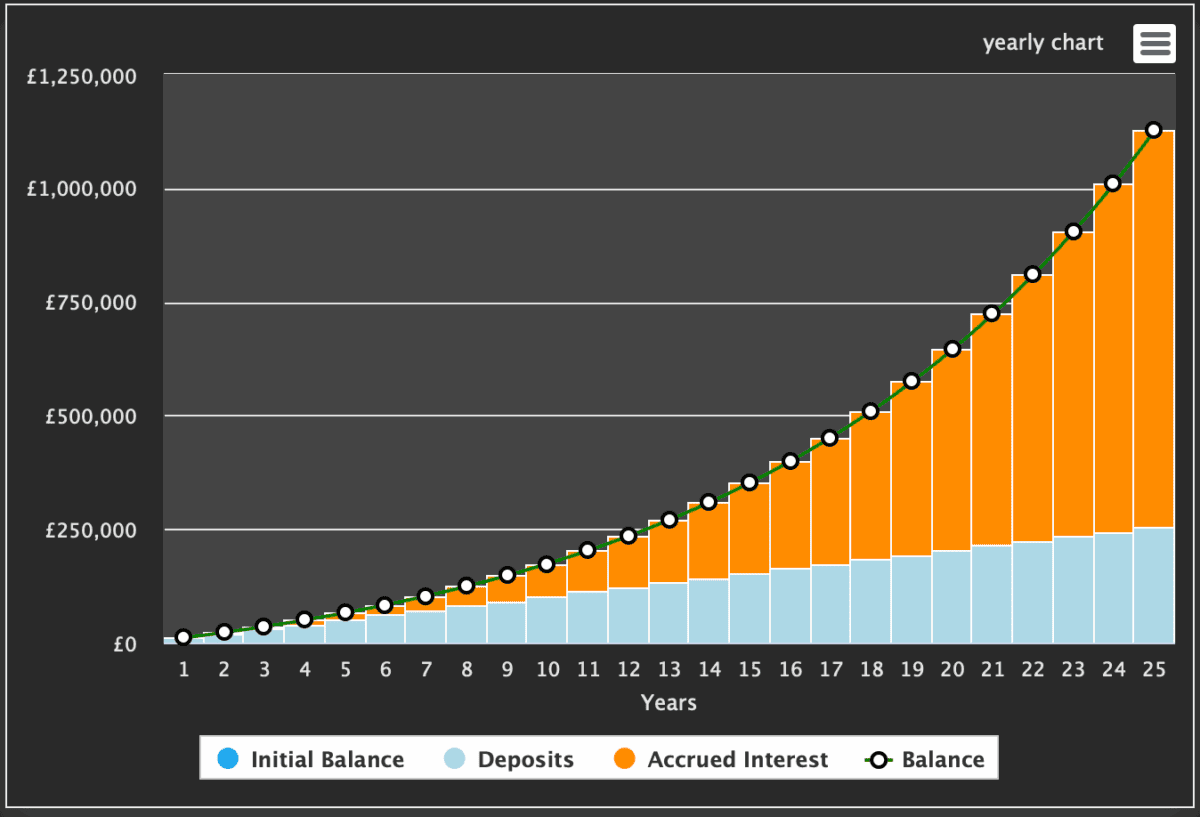

With an annual ISA contribution limit of £20,000, it’s clear that you can’t build an £800,000 portfolio overnight. But when using half the allowance, an investor could theoretically get there in 25 years.

Knowing where to invest

As I said above, the theory is easy. Actually investing in the right stocks, trusts, funds, bonds etc, is the hard part.

At The Motley Fool, my peers and I believe the best way to build a portfolio for the long run is by choosing well-researched stocks.

And for me, that means starting with the raw data or running screens.

One stock that stands out from a valuation perspective is American chipmaker Marvell Technology (NASDAQ:MRVL).

Marvell stands out because its valuation looks far more attractive once growth is taken into account. While headline price-to-earnings (P/E) multiples appear elevated, the forward price-to-earnings-to-growth (PEG) ratio of 0.74 is less than half the sector median, suggesting the market is underpricing its earnings growth.

That matters far more than raw multiples for a company exposed to long-term data centre and AI demand. Crucially, this valuation is backed by a strong balance sheet, with modest net debt relative to a $72bn market capitalisation, giving Marvell flexibility to invest through the cycle.

Risks? Well it needs to execute to justify its higher P/E — 29 times. And the issue is that its ASIC — the specialised chips (not GPUs) used in servers and data centres — positioning is weaker than Broadcom.

Nonetheless, I definitely think it’s worth considering. Current forecasts suggest the forward P/E would drop to 11 times for 2029. That looks cheap for the sector.