Many investors dream of generating £1,000 per month in passive income without relying on a salary. Using a combination of consistent contributions, compounding growth, and careful planning, it’s achievable.

Crunching the numbers

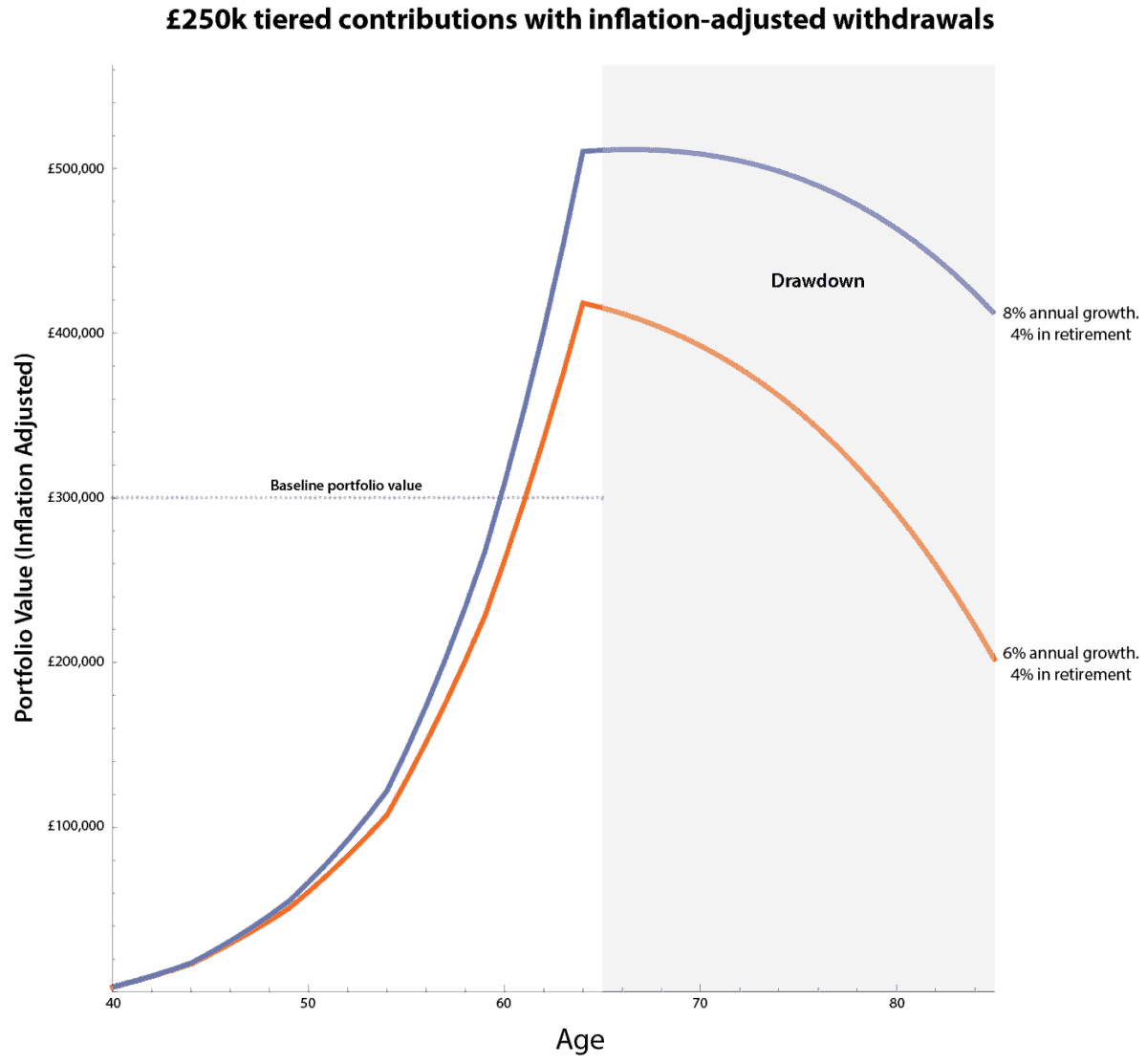

To earn £12,000 per year in today’s money, the widely used 4% rule suggests a target portfolio of around £300,000. This is the balance needed to withdraw £1,000 a month indefinitely while maintaining purchasing power.

In practice, investors often start with smaller contributions and gradually increase them as income grows. Over a working life, this can accumulate roughly £250,000, a simple round figure to illustrate how consistent saving and compounding build wealth over time.

Using a lifetime ISA with realistic growth assumptions, the chart shows a 6% annual return reaching the target in about 22 years, while 8% returns get there in 20 years. Assuming a 25-year investing horizon provides a buffer against market shocks, such as stock market crashes.

Chart generated by author

The key is sustainable withdrawals in retirement. Inflation steadily erodes purchasing power, so I adjust the £1,000 monthly income over time to maintain its real value.

At retirement, I assume returns drop to 4% to reduce risk once contributions stop. Even so, both scenarios leave a sizeable portfolio, which could support a long retirement or serve as a nest egg for children’s inheritance.

Dividend payer

With the target portfolio in reach, the next step is choosing investments that can sustain and grow income. One option is high-quality, dividend-paying FTSE 100 blue chips.

Legal & General (LSE: LGEN) might not have grabbed the headlines like peer Aviva last year, but its 8.2% dividend yield is exactly why it earns a place in my Stocks and Shares ISA.

On paper, things look a little alarming. Earnings barely cover the dividend, operating cash flow has been negative for the past two years, and traditional metrics raise concerns about sustainability.

But for insurance companies, traditional accounting numbers rarely tell the full story. Most profits are tied up in long-term products like annuities, so I focus on operating surplus generation (OSG). This forward-looking measure gives a clearer picture of sustainable dividends and long-term capital generation.

In 2026, dividends should grow by 2%, while OSG grows by around 5%, creating a healthier buffer for income-focused investors.

Of course, there are risks. Its large bond portfolio could come under pressure if inflation keeps pushing yields higher, potentially reducing OSG and delaying improvements in dividend cover.

Growth drivers

Looking long term, the insurer is well placed to capitalise on the growing pension risk transfer (PRT) market. Trustees of final salary pension schemes continue to rely on its expertise to derisk their portfolios. With markets remaining volatile, I don’t see this trend changing any time soon.

Over the next few years, the company expects to write £50bn-65bn of PRT, generating a steady, predictable stream of profits. That cash can then be deployed into its asset management division, adding another layer of income potential.

I own Legal & General for its passive income and long-term cash flow visibility, and it’s a stock I’m happy to hold. For investors chasing high-yielding, sustainable dividends, it’s certainly one worth considering.