2025 will be a hard act to follow for the global stock market. In the UK, the FTSE 100 enjoyed its best year since 2009. Share prices are soaring the world over, reflecting hopes of more growth-boosting interest rate cuts over the short term.

The New Year could see further stunning gains as investor confidence booms. But beware: enormous gains like we’ve seen last year could also prompt a sharp pullback.

Yet I’m still confident that 2026 could be a pivotal year in creating a new wave of ISA millionaires. And it has nothing to do with how stock markets may perform. What could I possibly be talking about?

Investing taking over?

From April 2027, the annual allowance on the Cash ISA will be slashed from £20,000 currently to £12,000. We’re some way off that date, but November’s announcement has already sparked a wave of panic among UK savers.

Like many Cash ISA users, I don’t like the plans. Even though I don’t get anywhere close to using the yearly, I prefer the ‘carrot’ instead of the ‘stick’ approach when guiding people on how to use their cash.

That said, I understand the government’s determination to nudge people from low-yielding savings accounts. It’s already ignited interest in products that could generate higher, and even life-changing, returns. As a stocks investor myself, I think that’s a good thing.

I’m hoping 2026 will be the year that a new wave of stock market millionaires emerges.

Millionaire boom

We all dream of making a fortune with share investing. I’m sure that’s the reason you’re here reading this. But it isn’t a pipe dream, as recent research from Plum shows.

There are currently 5,070 ISA millionaires recognised by HMRC, the number having grown by more than 1,000% in just seven years. It’s a list overwhelmingly dominated by Stocks and Shares ISA investors, who’ve enjoyed the tax benefits also enjoyed by Cash ISA users but have harnessed the wealth-building power of the stock market.

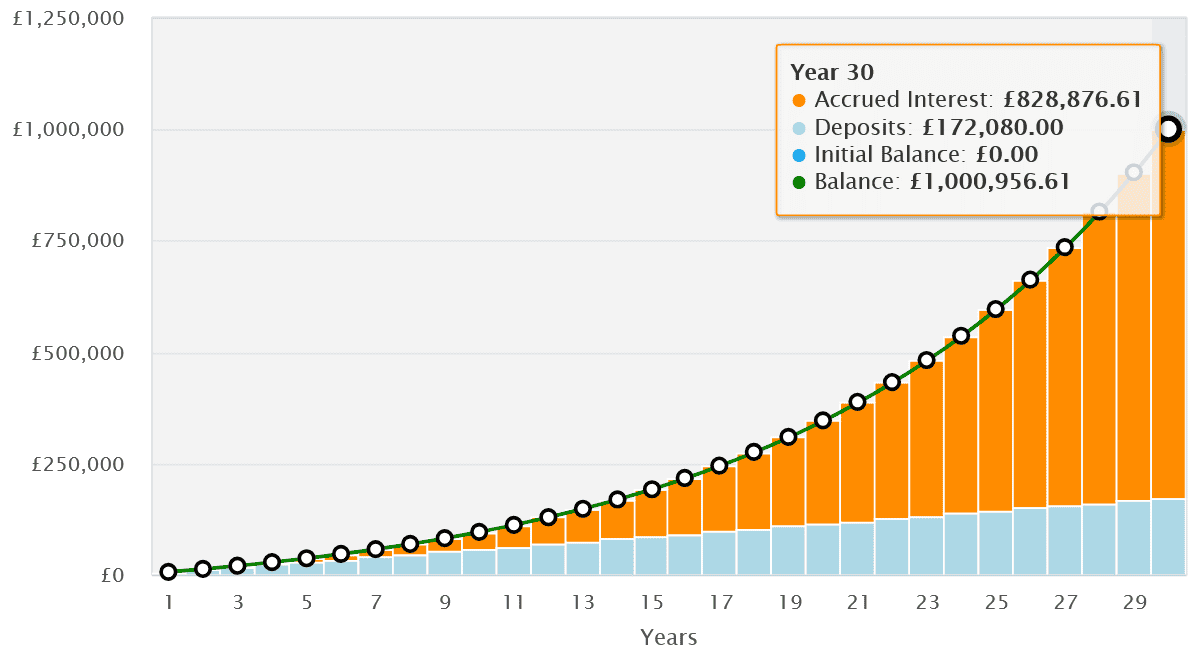

Since 2015, the average annual return on the investing ISA is a whopping 9.64% (according to Moneyfacts). That kind of performance can turn even a relatively modest monthly investment into a seven-figure portfolio over time.

Someone investing £478 a month could generate a £1m pension pot after 30 years, based on that impressive figure.

Buying the FTSE 100

Stock market investing involves higher risk than saving cash. But individuals can buy tracker funds like the iShares FTSE 100 ETF (LSE:CUKX) to limit volatility and target brilliant returns.

Like any shares-based fund, this product can drop during a broader market downturn. However, by diversifying across the whole FTSE 100 index, investors can protect themselves from company-, sector- and region-specific shocks.

And the beauty of exchange-traded funds (ETFs) like this is that they offer these risk and reward benefits at very low cost. The yearly management fee on this product is a rock-bottom 0.7%.

Including dividends, this FTSE 100 fund’s delivered an average annual return of 13% over the last five years. For both new and existing investors, I think it’s a top option to consider to target stock market riches.