Boosting one’s earnings with a second income is a New Year’s resolution for many of us – especially if it can be built tax-free inside an ISA. But what does it really look like beyond the spreadsheet? This article walks through a concrete example: regular contributions, the magic of compounding, and disciplined investing can turn that dream into a financial reality, whether you’re starting at 25, catching up at 40, or managing withdrawals at 55 or later in life.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

The power of time

Life isn’t tidy. A young saver may be focused on a house deposit, a 40-something might be thinking about maximising contributions, and others scale back or go part-time in their 50s for a variety of reasons.

The table below shows a tiered contribution strategy reflecting these stages: modest amounts in the 20s, increasing throughout the 30s and 40s, and tapering in the 50s.

| Age | Yearly ISA contribution |

| 25-29 | £3,000 |

| 30-34 | £6,000 |

| 35-39 | £10,000 |

| 40-44 | £15,000 |

| 45-49 | £20,000 |

| 50-54 | £5,000 |

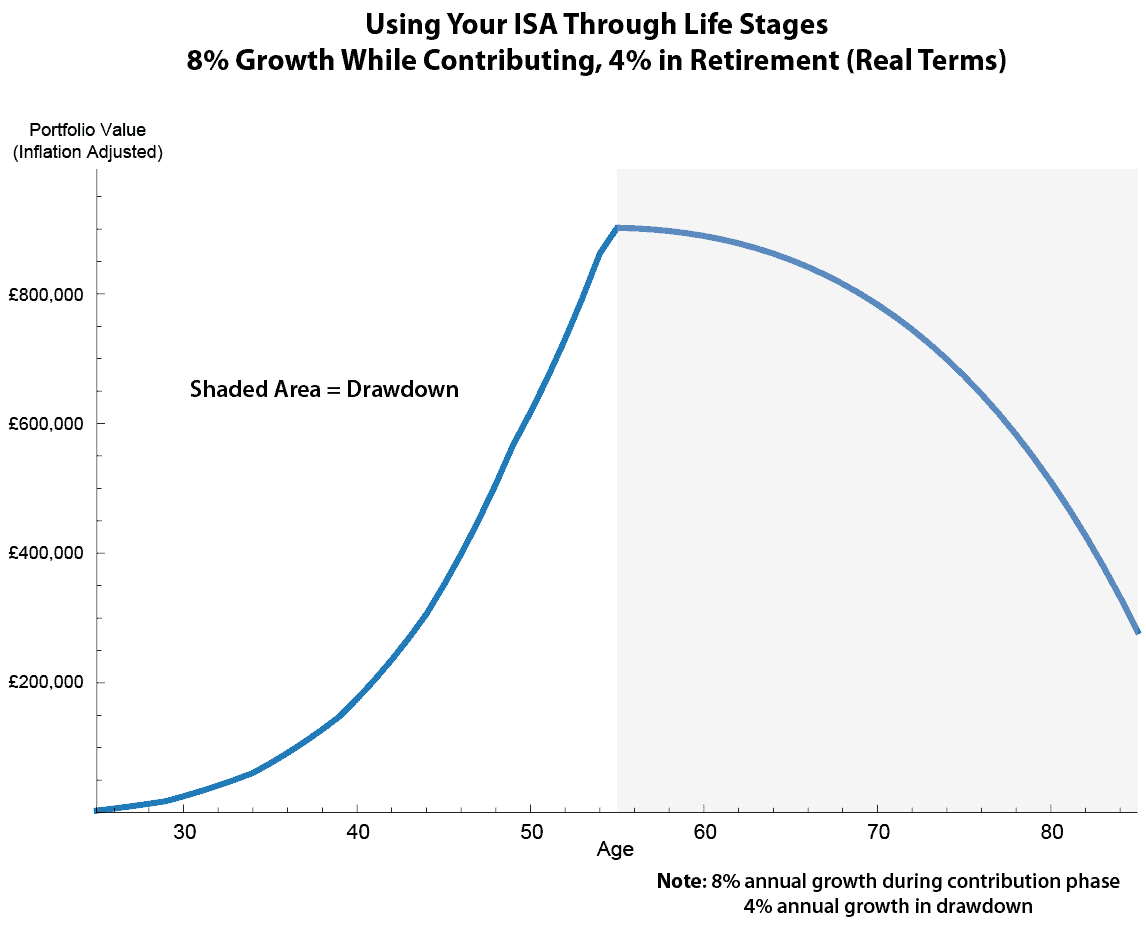

The following chart models these contributions.

Chart generated by author

Early contributions help build a foundation, but the story isn’t just about starting young. It’s about disciplined investing and the power of compounding working together over time to create sustainable passive income – whatever your starting point.

In retirement, two things change. First, the original £20,000 income target inflation-adjusts to around £36,000 a year by age 55, preserving its real purchasing power. Second, preserving capital matters more than chasing growth, which is why the model assumes portfolio growth falls to 4% throughout drawdown, rather than 8%.

The single line in the chart shows a path relevant to nearly everyone. Most importantly, it proves that life-stage adjustments – changing contributions, going part-time, or taking breaks – don’t derail a passive income strategy for long-term investors.

From model to reality

A model portfolio only matters if it can be translated into real-world stocks. In my ISA portfolio, I look for three qualities in a stock: an above-average dividend yield, confidence that income is sustainable, and the potential for capital growth alongside it.

Aviva (LSE: AV.) provides a useful illustration. The shares currently offer a dividend yield of around 5.3%, and recent results show the payout is well supported by cash generation, with free cash flow comfortably covering dividends.

Income does not have to mean stagnation, however. In 2025, the stock was up 42%, making it one of the FTSE 100’s strongest performers. Whether that pace can be repeated again in 2026 is uncertain, but underlying cash generation remains robust. The acquisition of Direct Line is intended to accelerate the shift toward more capital-light earnings, particularly in general insurance, which could support both dividends and longer-term value.

That said, the risks should not be ignored. Insurance pricing cycles can turn, competition can intensify, and higher claims costs or falling premiums could squeeze profits. In a less favourable environment, dividend growth – or even the dividend itself – could come under pressure.

Bottom line

My ISA isn’t about timing the market – it’s about compounding, sustainable dividends, and disciplined contributions. The chart shows that steady investing, even in small steps, builds real, tax-free passive income over time.