Tesla (NASDAQ:TSLA) stock went public in July 2010. And anyone who bought a decent chunk of shares not long after — say in 2011 — would have made life-changing returns over the next decade and a half.

Elon Musk’s venture made electric vehicles (EVs) cool for the first time. Today, its market cap is a stonking $1.5trn, making it the eighth-largest firm in the S&P 500.

In comparison, Joby Aviation (NYSE:JOBY) is a stickleback, with a $12.4bn market cap. However, I do see a couple of similarities with a young Tesla.

So, could buying Joby stock today at $13 be like investing in the EV giant years ago?

Tesla of the skies

Toyota-backed Joby Aviation is a US firm that has pioneered electric vertical take-off and landing (eVTOL) ‘flying taxis’. These can travel 100 miles on a single charge at speeds up to 200mph in almost total silence, save for a rushing wind sound, like the rustling of leaves.

Similar to Tesla’s EVs then, these eVTOLs are a play on the green revolution, as they fly without needing fossil fuel. This means they could be very disruptive, replacing noisy, polluting helicopters while also creating an entirely new mode of transport.

Another similarity is the company’s vertical integration. Like Tesla, which builds its own batteries and software, Joby designs and manufactures its own electric motors, propellers, and proprietary ElevateOS software.

Also, Joby is eying markets beyond flying taxis, including selling aircraft to third parties like the US military and hospitals (organ transport). This would open up aftermarket maintenance revenue opportunities.

Finally, Joby aims for autonomous flights one day (similar to Tesla’s robotaxis). It’s also developing hydrogen-electric technology, and has already completed a 523-mile test flight, with water as the only by-product.

Unproven model

Having said all that, I see a couple of key differences. One is more initial competition, including from Archer Aviation in the US and China’s EHang. So it won’t have key markets to itself like Tesla largely did in the early years.

Second, Tesla is primarily a product company whereas Joby is a service company. In other words, I can buy an EV but (alas) it’s highly unlikely I’ll ever own an eVTOL. This makes the business model far more unproven, multiplying the risks for investors.

The final stage

After flying more than 9,000 miles in 2025, Joby expects to begin a commercial air taxi service in Dubai in 2026. Then possibly the US afterwards, helping shepherd Delta Air Lines passengers to and from international airports.

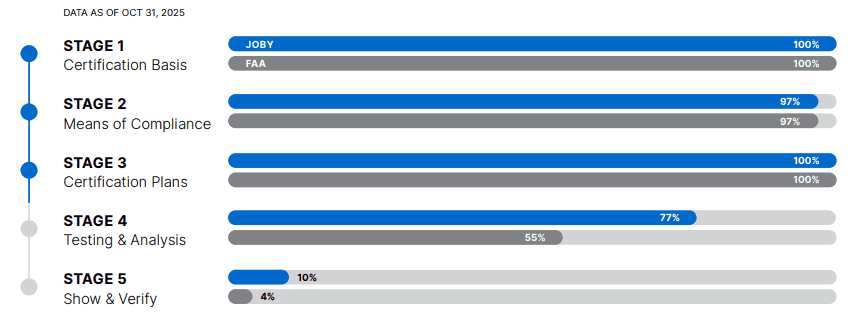

It’s currently into the FAA’s final stage of certification.

The company ended Q3 with nearly $1bn in cash, but it will almost certainly need more in future to build out a fleet of hundreds of eVTOLs.

Wall Street sees revenue reaching $570m by 2028, putting the stock at a lofty 22 times forward sales for that year.

| Route | Rough car journey time | Rough eVTOL journey time |

|---|---|---|

| Dubai Airport to Palm Jumeirah | 45 minutes (minimum) | 12 minutes |

| JFK Airport to Manhattan | 50 minutes | 7 minutes |

| Heathrow to Canary Wharf | 80 minutes | 8 minutes |

| Manchester Airport to Leeds | 60 minutes | 15 minutes |

Next Tesla?

I first bought Joby shares in 2023 at $4.50 each. However, after they surged to almost $20 in August, I sold a large part of my stake.

I’m holding onto my remaining shares, though, as Joby could indeed become another Tesla-like winner in future. Then again, it could crash and burn (hopefully not literally).

Investors interested in this speculative stock around $13 should know it’s very much high risk.