The stock market has had a fantastic run this year. As I write, the S&P 500 is up more than 16% while the FTSE 100 has returned around 23%, including dividends.

The performance of some household-name stocks has been even more spectacular. For example, Rolls-Royce is up 95%, while Lloyds has delivered a 75% return before dividends.

Shares of Google and YouTube parent Alphabet have jumped 61% year to date.

A dramatic difference

Last week, personal finance guru Martin Lewis highlighted the wealth-creating power of the stock market. In a presentation on his Martin Lewis Money Show, he showed that money held in cash savings accounts over the last 10 years would have actually lost value when inflation was factored in.

To break even after a decade of inflation, someone would have needed £1,390 back from £1,000. But Lewis highlighted that even the best cash savings accounts would only have generated £1,270.

In contrast, over the same period, some index funds have significantly increased the initial investment. For example, £1,000 invested in the S&P 500 would now be worth about £3,790 (with reinvested dividends).

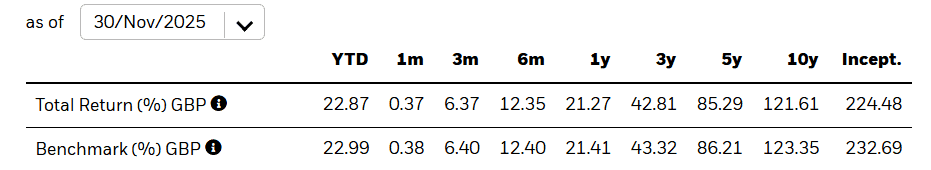

For some reason, Lewis’ presentation didn’t show the FTSE 100’s return. But the iShares Core FTSE 100 ETF has generated a total return of about 122% over the past 10 years, thereby turning every £1,000 invested into approximately £2,220.

Long-term mindset

So, what was the golden rule of investing that I think Lewis just highlighted? It was this: “Only invest what you won’t need for at least five years, after clearing expensive debts and building an emergency fund.”

This is crucial because shares can swing wildly from one year to the next. But investing over a five-year period — or ideally a decade or more, as shown above — should iron out these natural ups and downs.

While clearing expensive debts is self-explanatory, having an emergency fund is an often overlooked step towards building an investment pot. But this is important because having one drastically reduces the need to suddenly sell shares (possibly at a loss) to raise cash for emergencies.

As the late investor Charlie Munger once said: “The first rule of compounding: Never interrupt it unnecessarily.”

Compounding is arguably an investor’s best friend, working its wealth-building magic over time. So it needs leaving alone.

FTSE 250 trust

Lewis said that risk-averse beginners should probably opt for funds like index trackers. I think high-quality investment trusts could also be worth considering in this case, particularly City of London Investment Trust (LSE:CTY).

First launched in 1891, this FTSE 250 trust aims to provide long-term growth in both income and capital. It holds top UK shares like HSBC, Shell, Unilever, and NatWest, with the portfolio collectively offering a decent 4.12% dividend yield.

Incredibly, City of London has raised its annual dividend for 59 consecutive years. That’s because it “focuses on cash-generative businesses, able to grow their dividends“. This is the kind of deep stock analysis beginners can happily leave to the professionals. In fact, some experienced investors do as well!

Of course, as with every investment, there are risks. One is that lower interest rates might push investors out of steady dividend-payers and towards racier growth stocks. In this scenario, the trust could underperform for a while.

On balance though, I reckon this trust will do well over the next decade, likely leaving cash returns in the dust.