FTSE 250 investors will know Greggs (LSE:GRG) shares have been a dumpster fire over the last year. I myself have had my fingers burned in the chaos — I opened a position in the battered baker in November 2024, and added to my position two months later.

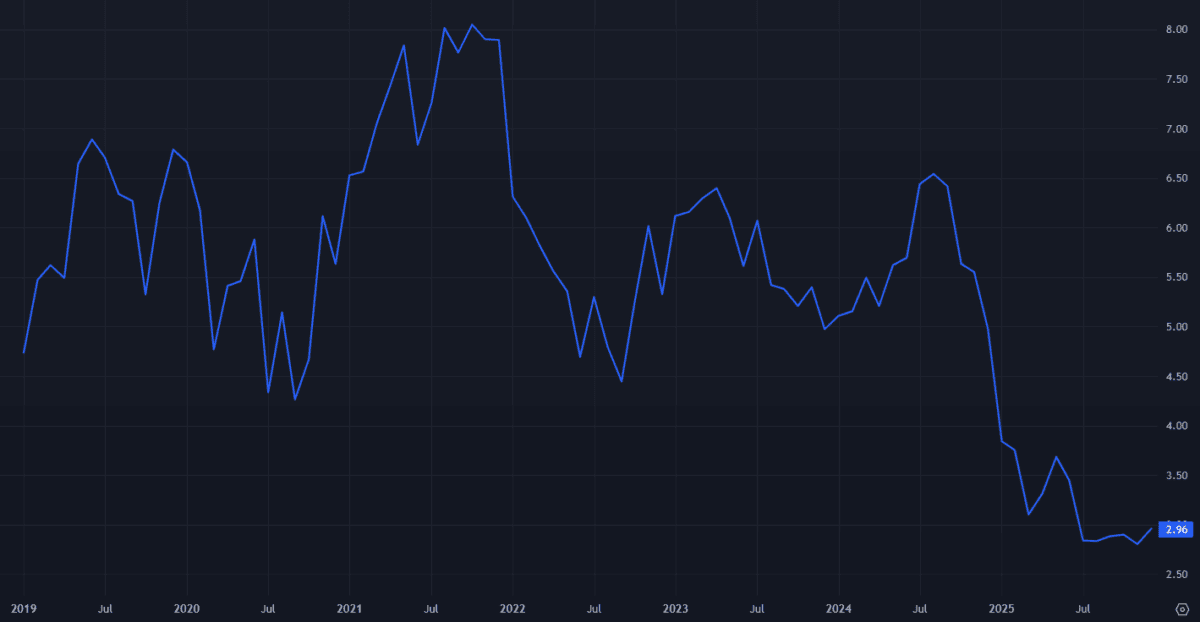

Since 1 January, Greggs’ share price has crumbled like one its pastries, to £16.41. That represents a 42% decline, and means a £5,000 investment at the start of the year would now be worth just £2,900.

Challenges remain as UK consumers keep their purse-strings tightened. However, if City analysts are correct, the company could be on the verge of a spectacular recovery.

So just how much cash could investors make by this time next year?

29% price rise?

Greggs shares are followed by a large list of analysts. One of these is JP Morgan, which began coverage this month and — encouragingly — attached an Overweight rating to the stock.

It predicted a rebound in earnings and free cash flow from 2026, driven by improving consumer spending power. It also praised Greggs as a “structural winner” that enjoys a number of market-leading metrics including

gross profit per square foot, underlying profit per square foot, revenue per operating lease, and gross profit per operating lease.

The baker’s valuation is now at “trough” levels, JP Morgan said, as it approaches the bottom end of its profits cycle. With the outlook brightening, a sharp rebound in Greggs shares is tipped.

It set a two-year share price forecast of £21.10 on Greggs. This suggests a potential rise of 29% from current levels.

Dirt cheap

Based on this forecast, someone buying £5,000 of Greggs stock today would make £6,426 (excluding dividends).

Looking at the rock-bottom valuation JP Morgan mentions, it’s easy for me as a good bargain lover to get excited.

Today Greggs’ price-to-earnings (P/E) ratio (on a forward-looking basis) is 13 times. That’s significantly below the 10-year average of 22.4 times.

Meanwhile, the company’s price-to-book (P/B) ratio has toppled to around three times. It suggests Greggs still trades at a premium to its asset values — this reflects in part its industry-leading metrics.

But as you can see, this is also spectacularly low from a long-term perspective.

Is Greggs a Buy?

There are clear risks to Greggs’ recovery, from the challenging consumer landscape to intense market competition. Rising costs are another problem it needs to navigate.

Yet I’m confident sales and profits will spring higher from next year. I think hikes to the minimum wage could boost demand for its sausage rolls and sweet treats. Ongoing store expansion — and especially in high-footfall areas like travel hubs — should also support earnings growth next year and beyond.

My ownership of Greggs shares hasn’t got off to a particularly good start. But I’m confident my investment will deliver excellent returns over the long term. While not without risk, I think it’s a top stock to consider.