The Autumn Budget’s changes to the Cash ISA limit mean anyone thinking about passive income may need to rethink their strategy. I ran the numbers to see how big an ISA pot someone would need to target a £16,000 yearly income – that’s £1,333 a month. Could this be achievable with a typical savings plan?

Crunching the numbers

Using the classic 4% rule, an ISA pot of around £400,000 could hypothetically generate £16,000 a year in passive income – a useful benchmark for thinking about the size of the pot needed.

So how much might someone need to contribute to their Stocks and Shares ISA to reach that level?

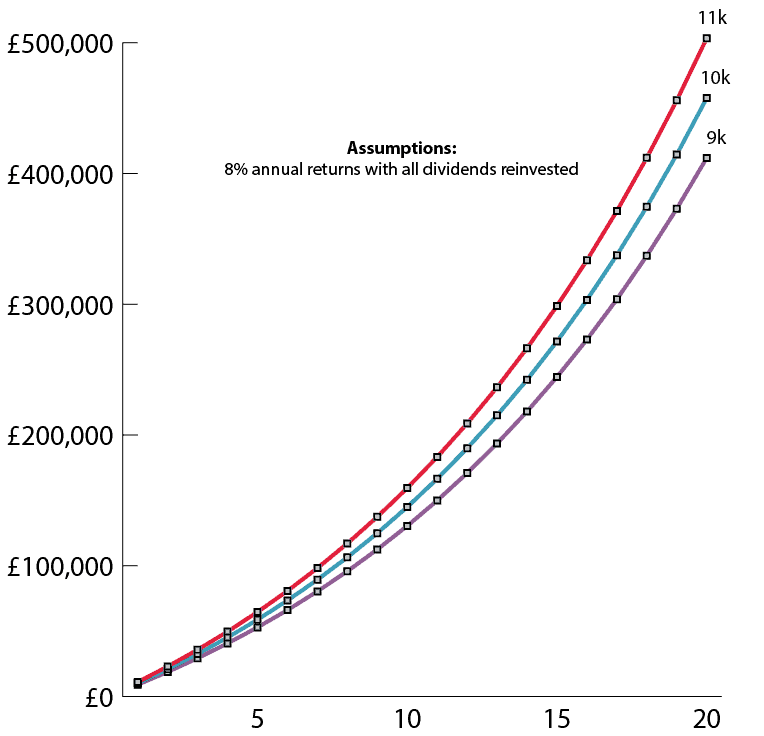

Most people won’t invest the same amount every year, so I modelled three simple scenarios in the chart below. With fixed annual contributions of £9,000-£11,000 over 20 years, reinvested dividends, and an 8% return, the projected ISA balances are:

| Annual contribution | £11,000 | £10,000 | £9,000 |

| Projected pot | £503,000 | £457,000 | £411,000 |

Chart generated by author

Blended portfolio

Reaching a target ISA pot isn’t just about dividends. Growth matters too – compounding over time can make a huge difference. A mix of dividend-paying and growth-oriented stocks can help a portfolio aim for an average annual return around 6–8%, which is what the earlier scenarios assumed.

For me, one of my favourite growth stocks right now is Fresnillo (LSE: FRES). The Mexican miner has surged alongside silver’s explosive rally, a move that has left gold and the Magnificent 7 stocks far behind.

Commentators have predicted a pullback for months, yet the shares keep powering on. They’re up 400% in 2025 and another 9% this week, making it the FTSE 100’s standout performer.

The appeal is obvious. With an all-in sustaining cost near $17 and silver at $64, margins are huge. The firm expects to produce roughly 50m oz ahead, with demand driven not just by central banks but fast-growing industrial use in solar panels, EVs, electronics, and defence tech.

But the risks remain. Silver is extremely volatile, and Fresnillo’s share price tends to move in lockstep. Operational setbacks or regulatory issues at its mines could also hit output and margins even if the metal stays elevated.

Solid player

For ballast, my ISA portfolio includes Aviva (LSE: AV.). Its latest updates showed real momentum, helping justify a 39% jump in the share price in 2025. General insurance premiums climbed 12% to £10bn, boosted by the Direct Line acquisition and strong growth across both Personal and Commercial Lines. Wealth inflows were up 8% too, showing customers are still putting money to work.

For me, the main draw remains the dividend. It’s no longer the superstar it once was, but a 5.4% yield is still comfortably ahead of the FTSE 100 average. And while dividend cover looks thin on an earnings basis, the cash story is far stronger – operating cash flow was more than nine times the payout, which reassures me on the sustainability front.

There are risks, though. Aviva depends heavily on bond income, so falling interest rates or rising corporate defaults could squeeze returns and slow future dividend growth.

Bottom line

To build passive income in my ISA, I need both growth and steadiness. Fresnillo gives me momentum, Aviva gives me ballast, and together they keep me moving toward my income goals.