The Autumn Budget landed yesterday (26 November), and one change immediately caught my eye: the Cash ISA allowance for under-65s has dropped from £20,000 to £12,000. I asked ChatGPT what this could mean for the stock market – and the answer was clear: with less room for cash, more investors are likely to gravitate to Stocks and Shares ISAs.

Cash is king

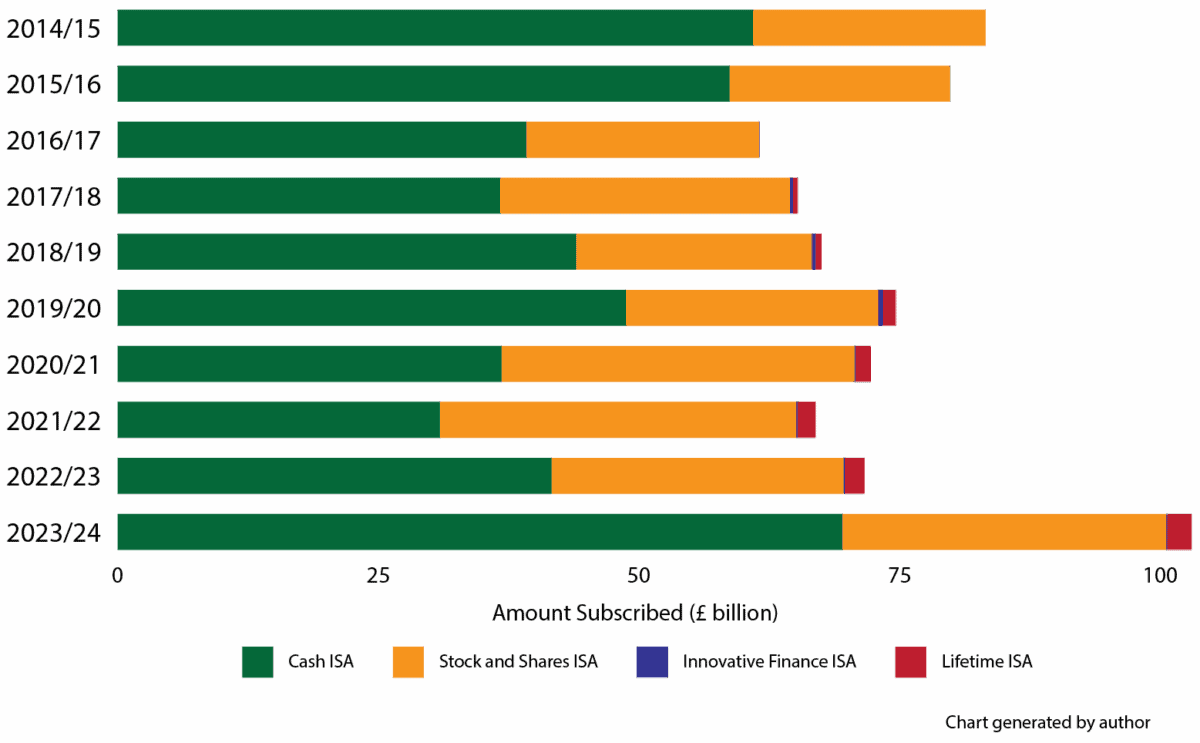

I could have worked that out for myself. But ChatGPT was right about one thing – cash ISAs dominate the UK savings market. In the last financial year, for every new Stocks and Shares ISA opened, 2.42 Cash ISAs were opened.Of the total £103bn in ISA savings, over two-thirds is held in Cash ISAs. The full breakdown is shown in the chart below.

HMRC data

Most cash savers play it safe, so if they do begin to gravitate into a Stocks and Shares ISA, they’re likely to stick with what feels solid – FTSE 100 dividend payers. These household-name companies offer steady payouts and familiarity.

Dividend plays

The FTSE 100 is packed with dividend payers offering much more than a Cash ISA does. But I am conservative by nature and so I want to see really strong evidence that a stock could support its payments into the future.

One of my favourites remains household name Aviva (LSE: AV.). It holds number one positions in huge swathes of its business operations, including UK General Insurance, Protection, Workplace and individual annuities.

But it’s the mix of the portfolio that really is important to me. The acquisition of Direct Line group means that by 2028 over 75% of operating profit will be derived from capital-light operations. This mix is attractive for shareholders because it means stronger growth and better returns, but with less use of capital.

Recession fears

Of course, even the most cautious investors will want to weigh the risk of an economic slowdown. A weaker economy could hit key parts of Aviva’s business that rely on growth.

Workplace pensions provide a steady revenue stream, but if unemployment rises significantly, contributions could fall sharply. This is one of those hidden risks – not immediately obvious at first glance, but worth keeping in mind.

Another area to watch is General Insurance, the company’s biggest revenue generator. Premiums across home and motor insurance have dropped recently, and with the added costs of integrating Direct Line, profit margins could be squeezed.

Bottom line

The £12,000 cap on Cash ISAs may be controversial, but I think the UK stock market could be a beneficiary in the long run. Cash savers now have a clear reason to rethink where their money sits. That could drive meaningful change.

Beyond the Budget, the Mansion House Accord signalled a wider push for pension money to flow into private markets. If that idea is ever extended to everyday savers, I’m not convinced many cautious investors will embrace it. Most people naturally gravitate towards what they know and trust.

Aviva fits that profile. Over 40% of UK adults hold a policy with the company, putting it among the most recognisable and trusted financial brands in the country. It also offers a 5.5% dividend yield alongside growth opportunities across its diversified portfolio. These factors leave it well placed to benefit from the shake-up in Cash ISAs and I see it as worth considering.