Imagine investing in Nvidia stock in the early days, when today’s AI revolution was just a twinkle in CEO Jensen Huang’s eye.

The chipmaker’s stock market gains — up roughly 22,700% in a decade — are legendary. And this has understandably sparked a lot of interest in finding the next Nvidia-type hidden gem.

That seems to be the hope of people on investing platform AJ Bell anyway. Because according to company-complied data, the most popular stock bought there in the past day (24 November) was ITM Power (LSE:ITM).

Trading at 72p and sporting a modest market cap of just £449m, this stock is certainly still under the radar of many investors today. But it’s now up nearly 200% since March, so excitement is building.

Might it be a giant company in the making?

Green hydrogen pioneer

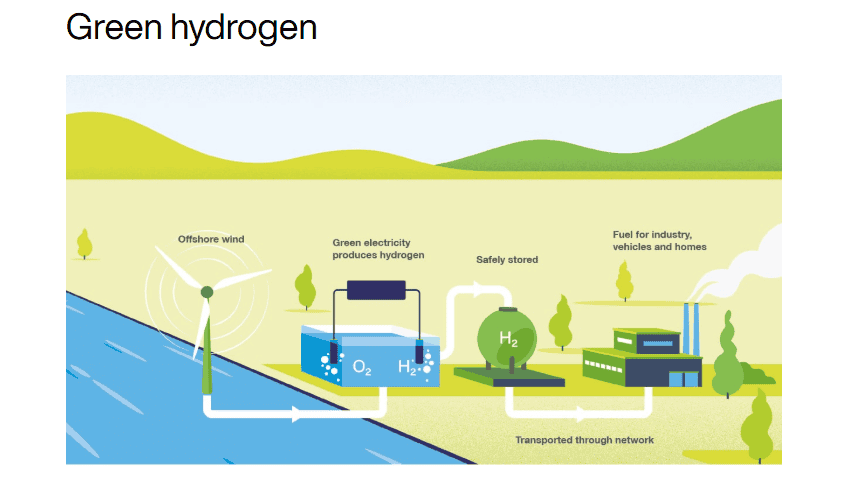

ITM Power makes electrolysers — industrial machines that split water into hydrogen and oxygen using electricity. As we all learned in chemistry class, water is two parts hydrogen and one part oxygen (H₂O).

Specifically, ITM builds the equipment needed to create green hydrogen, which can be used as a clean fuel for factories, trucks, steelmaking, chemical plants, and energy storage. Its NEPTUNE V units are the leading containerised product for mid-scale green hydrogen projects.

According to a 2020 report from Goldman Sachs, the global green hydrogen addressable market could potentially reach €10trn by 2050. That’s the year when many countries aim to achieve net zero.

Similar to Nvidia then, there’s a massive long-term potential growth opportunity ahead for ITM.

Sales are growing

After two decades in research and development mode, the company is finally starting to enjoy commercial success. In FY25, which ended in April, ITM’s revenue climbed over 50% to £26m.

Meanwhile, the order backlog has risen to more than £145m, representing a year-on-year increase of almost 90%. And for the current year (FY26), management expects revenue to jump another 50% or so to £35m-£40m.

Looking further out, analysts see the top line reaching approximately £78m by FY27. So this is a company that is currently experiencing strong sales growth.

With market demand accelerating, a world-class product portfolio, and a proven track record of execution, along with strong reference plants, ITM is well-positioned to lead the green hydrogen industry into its next phase of growth. ITM Power.

Red ink

Now, whereas Nvidia is one of the most profitable firms on Earth, ITM is still loss-making. This year, it expects an adjusted EBITDA loss of £27m to £29m, as it continues “to fill our factory for increased cost-absorption and recognise revenue on the legacy loss-making portion of our contracted order backlog“.

This is the real risk here, as City analysts don’t see an end to the red ink for quite some time. Also, after its near-200% surge, the stock is trading expensively at approximately 10 times forward sales.

The next Nvidia?

Stepping back though, I don’t see the stock as having Nvidia-like potential. After all, building electrolysers is a capital-intensive business, whereas Nvidia is a capital-light chip designer (it outsources manufacturing to TSMC).

That said, ITM is an interesting growth stock that adventurous investors might want to check out at 72p. It’s still down 89% since 2021!

However, I’m currently looking at other lucrative opportunities in the stock market.