Artificial intelligence (AI) can do a lot of things, but picking dividend shares isn’t one of them. The problem is that basic AI tools can’t do real analysis — rather, they simply regurgitate information from their massive data sources.

Somewhere in that data may be a few good picks, but the information’s often out-of-date or from an unreliable source. Considering how much inaccurate information is on the internet, more often than not the responses are riddled with errors.

For example, when I asked ChatGPT what dividend shares I should buy for retirement, one of its picks was Royal Dutch Shell (RDSB). That’s a name and ticker Shell stopped using years ago. Another two of its picks were tobacco stocks, an industry which is dying out and may no longer be around when I retire.

Its fourth pick was Diageo, a stock I still own but one I’m increasingly thinking about selling. The only real decent pick it came up with was Legal & General — and even it’s come into question lately after weak results.

So what selection of stocks would have impressed me?

Five dividend shares I’d pick

When thinking of retirement, the key factor I’m looking for is long-term sustainability. And I do mean long, because I’m not that old yet.

If there isn’t strong evidence the business will still be doing well in 30 years, I’m not interested.

With that in mind, my top picks would be Lloyds, Unilever, Tesco, National Grid and GSK (LSE: GSK). These are all long-running, heavily established businesses that are deeply entrenched in the day-to-day life of the UK.

The chances of any of them failing in the next 30 years are slim. I also think they’re among the companies less likely to abscond to a US listing. Moreover, they all operate in vastly different sectors, adding diversification.

Let’s take a closer look at why I think GSK’s a stock worth considering for retirement.

Long-term vision

Aside from having been around since 1715, I believe GSK could benefit a retirement portfolio due to its defensive business model. It has robust cash flows and a long history of paying dividends even during volatile market cycles.

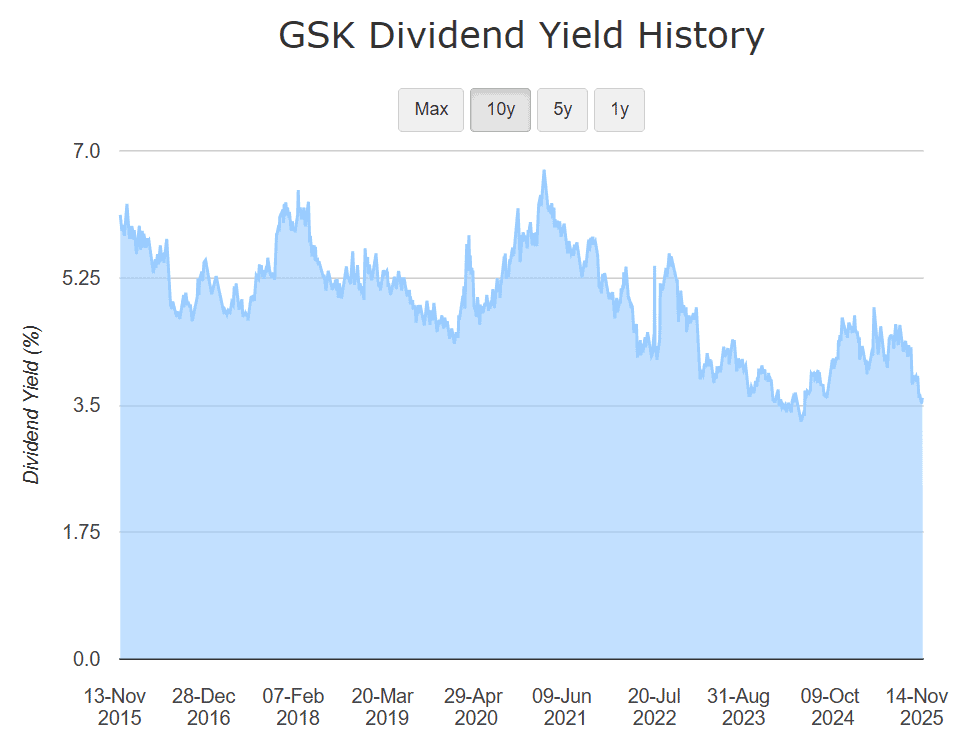

Operating in pharmaceuticals and vaccines gives it exposure to essential healthcare, a sector with steady revenues that tend to support reliable shareholder payouts. Admittedly, the current 3.6% dividend yield is barely above average but, historically, it’s usually higher.

More importantly, its track record and commitment to shareholder returns are what make it attractive. Plus, it has a diversified product portfolio and a verified pipeline of upcoming products, adding stability to retirement income planning.

Like any pharmaceutical company, it’s at risk from patent expiries, trial failures and regulatory setbacks. Its dividend history is impressive, but a lapse in earnings could still risk a cut.

My verdict

There’s a lot of information out there, but when it comes to picking stocks, real-world knowledge is critical. No investor should ever rely on advice without verifying the source and data. Ideally, the more research undertaken ourselves, the better informed we are.

The day may come when AI understands markets better than humans, but until then, I’m going with what I know.