In 2025, the UK stock market remains a happy hunting ground for investors seeking huge dividend yields. With many share prices tumbling, it’s possible to pick up top passive income stocks offering double-digit payouts.

Greencoat UK Wind (LSE:UKW) is a great example of one such share. The renewable energy stock has endured some challenges more recently, slashing its share price by around a quarter. Yet the FTSE 250 company has kept delivering strong dividends, and today its forward yield is an impressive 10.4%.

The question I must ask now is, can the business recover and continue delivering long-term dividend income?

Recent troubles

Greencoat has experienced a range of problems recently that have pulled its share price lower.

Calmer-than-expected weather conditions have impacted power production from its wind farms. Total output was 14% lower than budget in the first half, at 2,581GWh.

On top of this, the company’s experienced softer power prices than was expected. Added to interest rate pressures, Greencoat’s net asset values (NAVs) have significantly declined. These were 143.4p per share as of June, down from 151.2p a year earlier.

While this has impacted the share price, it hasn’t stopped the energy producer from raising dividends. It’s remained highly cash generative, and supported by asset sales, Greencoat’s hiked shareholder payouts and embarked on share buybacks.

There’s further good news for passive income investors, as City analysts expect dividends to keep on rising.

Soaring dividend yields

For 2025, Greencoat plans to hike the full year dividend to 10.35p per share, up from the 10p it had frozen rewards at in 2024.

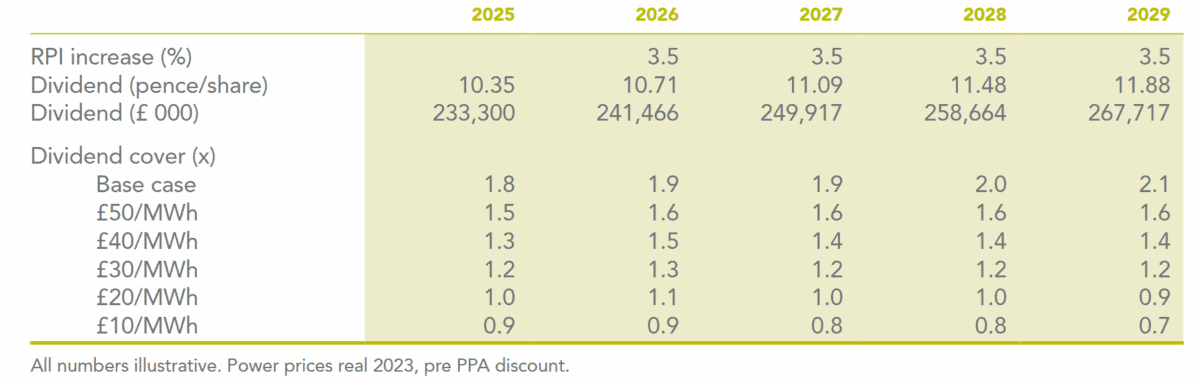

This 3.5% hike is in line with retail price inflation (RPI), and reflects “the company’s prospects, strong balance sheet and cash flow generation,” it said. The good news for investors is that Greencoat has targeted similar growth to the end of the decade:

What’s more, projected dividends over the period are well covered by expected net cash generation over the period, at 1.8 times to 2.1 times. This provides a decent cushion in case cash flows miss target.

Broker projections don’t currently stretch out this far. However, City estimates do back the company’s dividend targets through to 2027. And so the huge 10.4% dividend yield for this year marches to 10.7% for 2026, and to 11.9% for the following year.

A top cheap share

These figures underline Greencoat UK’s position as an excellent value stock to consider.

As well as having those enormous dividend yields, the business trades at an 27.6% discount to its NAV per share. To me, this suggests a potentially attractive entry point for long-term investors.

Further volatility cannot be ruled out given Greencoat’s reliance on unpredictable weather conditions. But over the long term, I expect it to deliver robust returns as green energy demand accelerates.

The company has some of the lowest costs in the sector. And its pricing outlook has improved following the UK government’s decision to ditch zonal pricing.